Register posting method

The Register posting method procedure is essential for Stock accounting![]() Stock accounting is a standard feature in Monitor ERP. It is used to continuously post all stock transactions in the system. This way the stock value in the Stock module matches the recorded value in the Accounting module. Changes in stock which are due to changed standard prices, direct stock reporting, arrivals and deliveries, stock count differences, nonconformities (cases), etc. will automatically be posted and give a better understanding of changes in stock and the company's gross profit margin in the income statement. and Management accounting

Stock accounting is a standard feature in Monitor ERP. It is used to continuously post all stock transactions in the system. This way the stock value in the Stock module matches the recorded value in the Accounting module. Changes in stock which are due to changed standard prices, direct stock reporting, arrivals and deliveries, stock count differences, nonconformities (cases), etc. will automatically be posted and give a better understanding of changes in stock and the company's gross profit margin in the income statement. and Management accounting![]() Management accounting is an option in Monitor ERP. It is used as a complement to the standard function called Stock accounting. The function means that all transactions on manufacturing orders (WIP value) are posted and transferred to the general ledger in the Accounting module in Monitor G5. The hours worked are recorded in the income statement, and provide a financial follow-up, for example, made per department and cost factor. Calculation differences are posted and these can be followed up per product, per order, etc. This function also contains extended management of cost of goods sold.. In this procedure, you define how different types of events should be posted. The system can help you to create posting methods. The settings will then be configured automatically. This is described below in the section Create posting method via guide.

Management accounting is an option in Monitor ERP. It is used as a complement to the standard function called Stock accounting. The function means that all transactions on manufacturing orders (WIP value) are posted and transferred to the general ledger in the Accounting module in Monitor G5. The hours worked are recorded in the income statement, and provide a financial follow-up, for example, made per department and cost factor. Calculation differences are posted and these can be followed up per product, per order, etc. This function also contains extended management of cost of goods sold.. In this procedure, you define how different types of events should be posted. The system can help you to create posting methods. The settings will then be configured automatically. This is described below in the section Create posting method via guide.

Posting of transactions is determined by so-called posting methods. You start by entering a Posting method (number) and Name. You also configure to which Log the posting method refers. Check the Active box if the posting method should be active. Inactive posting methods are not used in the Posting of logs procedure.

As standard you can only register how events that concern stock transactions should be posted. This is registered for the logs Stock transaction log and Price change log. When using the option Management accounting, also events that concern work and subcontract on manufacturing orders and calculation differences will be registered. This is registered for the logs Manufacturing order log and Calculation differences. The option Management accounting also allows posting of COGS (cost of goods sold) in the Invoicing log.

on toolbar of the procedure.

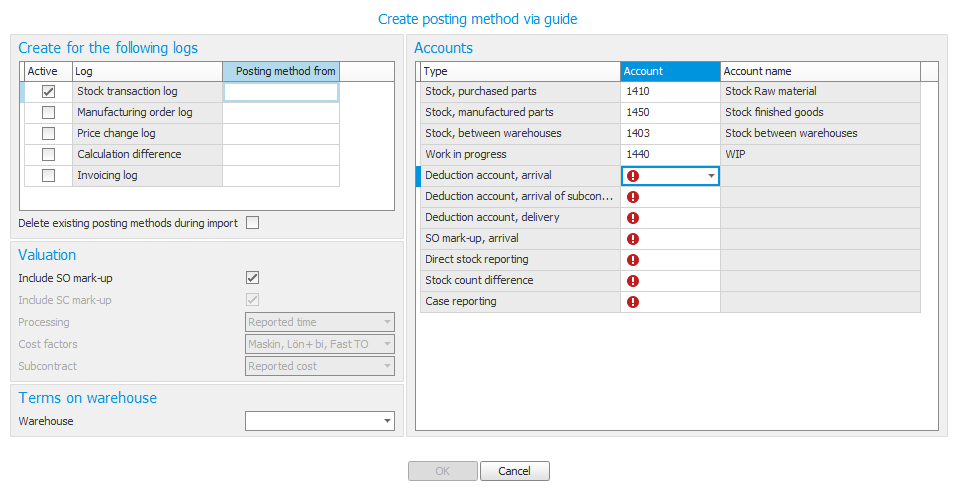

on toolbar of the procedure.By using the button Create posting method via guide  you can get help from the system to register posting methods. This guide is mainly used in connection with start-up of Stock accounting and Management accounting.

you can get help from the system to register posting methods. This guide is mainly used in connection with start-up of Stock accounting and Management accounting.

In this guide you enter which accounts should be used for each respective log. The system then creates automatic posting methods to post all transactions. This way you have a basis to start from and can later complement the posting methods, if needed. You can also use this guide several times to, for example, register posting methods per warehouse.

Here you find a description of the settings found in each respective box.

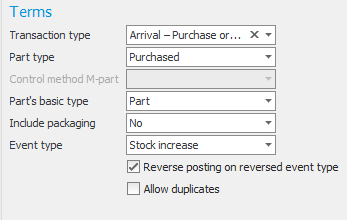

Here you enter different types of terms for the posting method. To be able to post the transaction by the current posting method, the entered terms must be fulfilled.

Please note! It is important that the terms have been correctly registered. Any incorrectly entered terms might lead to the transaction not being posted or being incorrectly posted. In some cases you might need several posting methods with almost identical terms. If you for example want to post arrivals differently depending on part type (purchased or manufactured), you register two posting methods with the same terms except for the term Part type. You use these different posting methods when posting arrival of purchased and manufactured parts.

In some cases you might need several posting methods with identical terms. This applies if the same transaction should generate duplicate or even more postings. An example of this is if you want to post both standard price and SO mark-up upon arrival, but you want a separate posting for the SO mark-up. Here it is important that you check the box Allow duplicates for both posting methods. Otherwise, the system will only post one of these.

In the field Transaction type, you determine to which type of event the posting method refer, for example Arrival – Purchase order. Part type determines to which part types the posting method applies. In the field Control method M-part, you select if the posting method should consider if the part is stock driven or order oriented.

In the Part's basic type field you select for which part types this posting method will apply.

Select Yes in the field Include packaging, if packaging parts should not be posted differently. Otherwise, you must create separate posting methods for packaging and select Only packaging for these and No for others (that does not refer to packaging).

In the Event type field, you select which direction the transaction has. If it is an increase or decrease of the stock. It is important that the event type reflects its posting. For example during stock increase, you enter the stock account on the debit side in the Posting box. You do not have to create a separate coding method for stock decrease. Instead you activate the setting Reverse posting on reversed event type. The system then automatically checks the transaction on the opposite side during stock decrease. However, if you want different posting depending on whether it is an increase or decrease, you register these with separate posting methods and uncheck the setting mentioned above.

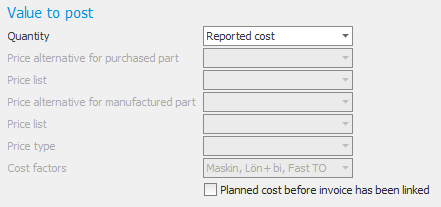

In this box you enter which value/amount should be posted for the current posting method. The fields available here depend on the log and terms entered for the posting method.

You can for example enter which price alternative for the part should be posted. The price can be determined separately for purchased and manufactured parts. If you for example in the Management accounting should post work cost on manufacturing order, you can instead enter Quantity, Price type, and Cost factors.

You find more information about each respective log in the Posting methods section.

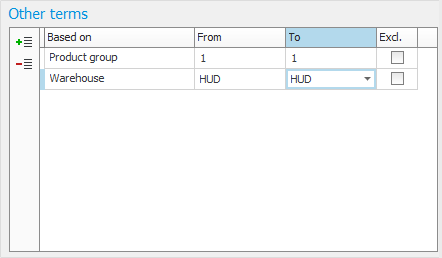

Here you can enter different types of Other terms for the posting method. To be able to post the transaction by the current posting method, the entered terms must be fulfilled. Please note! It is important that the terms have been correctly registered. Any incorrectly entered terms might lead to the transaction not being posted or being incorrectly posted.

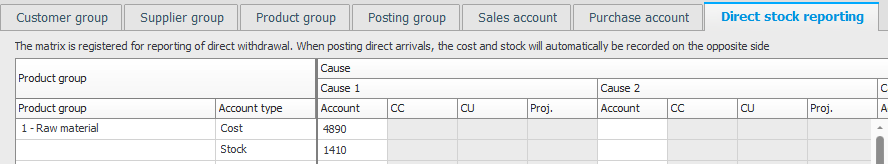

In the Other terms box you can determine different postings depending on for example Warehouse, Product group, Order type, etc. If you have not entered any Other terms, posting will be made. However, there are certain prerequisites, see example below.

The company has four warehouses (10, 20, 30, and 40). Warehouse 30 must be posted on separate accounts which is made in the Other terms box on warehouse 30. Other warehouses should be posted in a shared way. This is the easiest way to do this is:

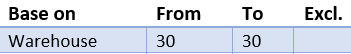

Posting method X for warehouse 30:

Posting method Y for other warehouses:

As you can see above, you do not have to enter other terms for the warehouses 10, 20, and 40. The system primarily posts using the posting method that corresponds to the entered term (posting method X above). If there are transactions where the entered term is not fulfilled, it will instead be posted by posting methods, if any, which do not have this term (posting method Y above). This way you do not have to create posting methods with selections that "cover" all other warehouses as in the example above. The example (method) above can also be used when more than one term has been entered as term/condition on the posting methods.

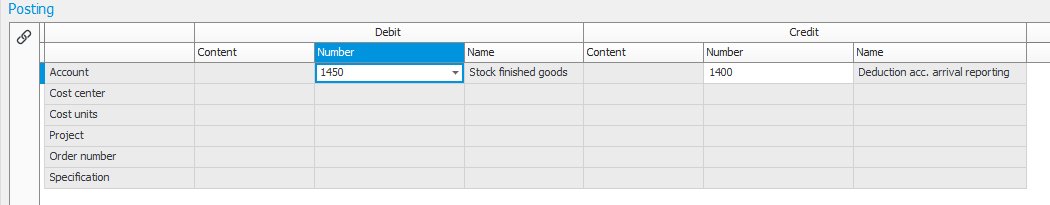

In this box you enter on which accounts, dimensions, etc. the transactions should be recorded. This is made for both debit and credit. Please note! The posting must be entered on the "correct" side. To make sure this is done, you can check what has been entered in the Event type field.

To be able to enter dimensions, the account must have dimensions entered in the Chart of accounts procedure. In the Contents field, enter Fixed "dimension" if, for example, you want to enter the cost center on which the transaction is recorded (this term varies depending on what type of dimension the row has, such as Fixed cost center or Fixed cost unit). The system can also perform dynamic posting of dimensions. For example set the part's product group as cost unit or set the work center's department as cost center. However, this requires that you in advance have registered all product groups as cost units and all departments as cost centers. Please note! You should select the alternative Mandatory for the dimensions in the chart of accounts when you perform dynamic posting of dimensions. Otherwise, the transaction will be booked without for example cost unit, if you have not created a cost unit for the product group.

Regarding posting on dimensions you can also post based on the row's warehouse. Provided the Warehouse option is used and you have activated settings for posting of CC, etc. based on warehouse.

If you use the posting dimensions connected to registers (e.g., Part, Product group, Work center![]() A work center is a part of the factory. It can be a single machine or a group of machines, a single workstation or a group of workstations., Department or Employee), there is an automatic posting against the dimension code the transaction refers to. In this case, they do not have to be registered as dimension codes in the Dimensions

A work center is a part of the factory. It can be a single machine or a group of machines, a single workstation or a group of workstations., Department or Employee), there is an automatic posting against the dimension code the transaction refers to. In this case, they do not have to be registered as dimension codes in the Dimensions![]() Dimensions are used by large companies in their accounting in order to divide up activities and make it easier to track internal results. An account is a dimension, although large companies usually use the dimensions cost center (CC), cost unit (CU) and project. In addition to these you can create other dimensions in Monitor ERP based on your own operational follow-up. procedure. There is more information about this in the Dimensions section in the Dimensions procedure.

Dimensions are used by large companies in their accounting in order to divide up activities and make it easier to track internal results. An account is a dimension, although large companies usually use the dimensions cost center (CC), cost unit (CU) and project. In addition to these you can create other dimensions in Monitor ERP based on your own operational follow-up. procedure. There is more information about this in the Dimensions section in the Dimensions procedure.

The Order number field displays if the account is configured to post on order number. This is especially suitable to configure on balance accounts to simplify the reconciliation against the general ledger. By checking the box Specification in the chart of accounts, you will also have a more detailed general ledger. On the posting method you can then enter that the part number should be transferred to the specification field in the general ledger.

In the Posting methods section, you find information about what to consider when registering posting methods for different logs.