Posting methods

Here you find examples and tips on how to register posting methods for different logs.

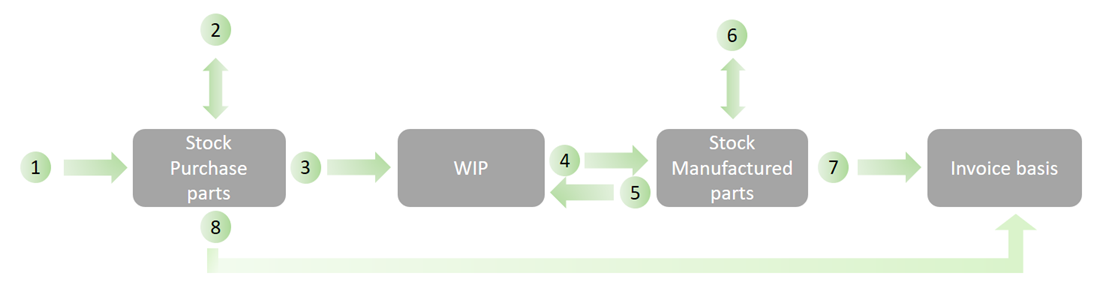

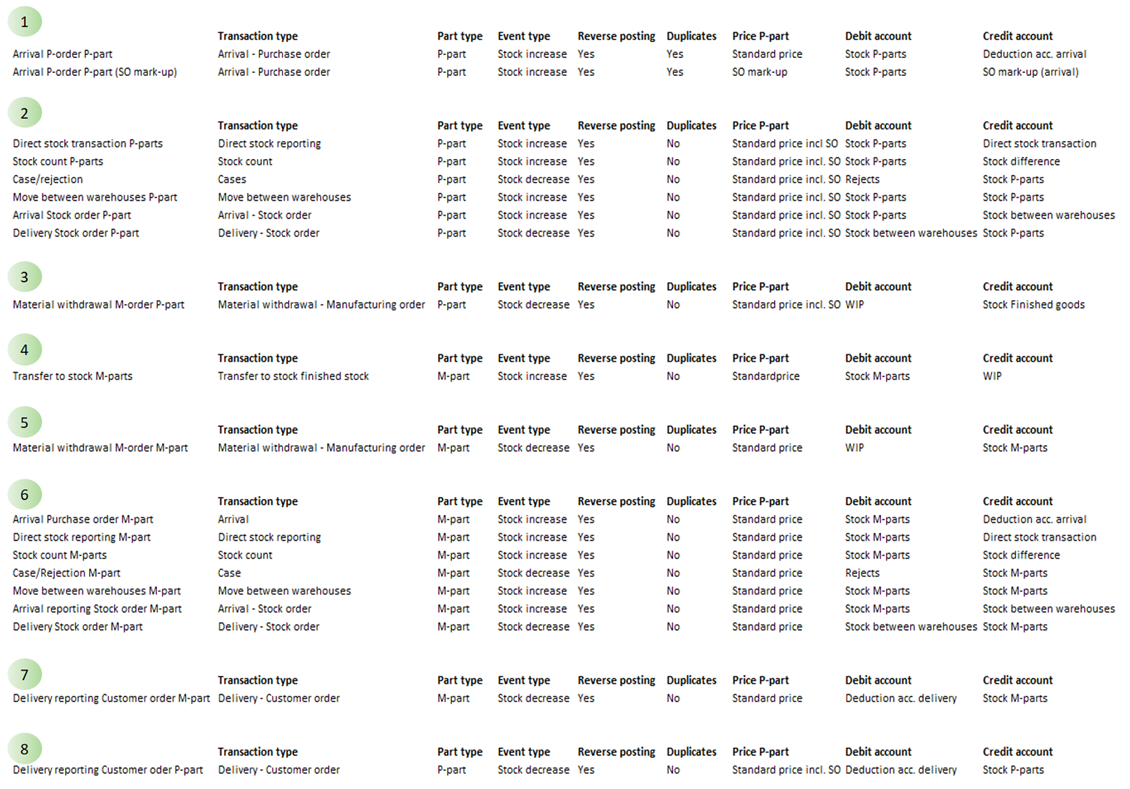

To be able to post/record all stock transactions, you must register posting methods for stock transaction log. These posting methods handle the following stages of the flow (items 1-8 below):

The value that is recorded in this log is: Balance change × selected price alternative.

In the table below you find an example of how to create posting methods for stock transactions according to the numbered arrows above. In the example, posting of standard prices are applied as well as SO mark-up for purchased parts. Separate stock accounts are used for purchased and manufactured parts. Which stock account will be used is determined by the Part type. However, it is possible to use other fields for the part to determine this. If you have a shared stock account, the number of registered posting methods can practically be reduced by 50%. However, if you have many stock accounts due to warehouses, you need to increase the number of posting methods. There should be one flow per warehouse/stock account. This can be solved by using warehouse as Other terms on the posting methods.

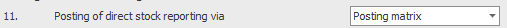

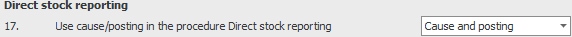

This transaction type (item 1 and 6 above) differs from other transaction types in the stock transaction log. For this reporting type you can determine if the posting should be loaded from the posting method or from the posting that was entered at the time of the reporting. Reporting of withdrawals and returns of tools is also handled using this posting method (Tools & Maintenance is an option). This is determined by the system setting below which is found under the Accounting tab:

If you select Posting matrix, the posting entered at the time of the reporting will be loaded. This is the most common method to use. The setting below, found under the Stock tab, must also be set to Cause and posting in order for this to work.

When the setting above has been configured, you enter the default posting for these in the Posting matrix procedure, under the Direct stock reporting tab. Read more about this in the section called Startup settings.

In the field Price alternative for purchased part, you can select how expenses for purchased parts should be posted. For the different posting methods, you can choose if the price alternative should be set to Standard price excluding expenses or just Expenses. Please note! If no calculation exists for the part, the system will post zero in value. Therefore, it is especially important that the purchased parts have a standard price calculation when these price alternatives are used.

If calculation parts of standard price are set to be posted in the field called Price alternative for manufactured part (for example material cost, processing cost), the value that is being posted is loaded from the calculation register for the part. Please note! If no calculation exists for the part, the system will post zero in value. Therefore, it is especially important that the manufactured parts have a standard price calculation when these price alternatives are used.

In the system setting below, found under the Accounting tab, you can choose if the values should be loaded from Current calculation or Current calculation at time of reporting.

The alternative Current is recommended if performance problems occur when posting stock transaction log in the Posting of logs procedure.

If you use the Product configurator option, the following value is recorded when posting the transaction types Transfer to stock to finished stock (4) and Delivery – Customer order (7): Balance change × standard price or calculation part from the configured calculation.

When an order (customer order/manufacturing order) is configured, a standard price and calculation which are unique for this order are saved. When using the product configurator, this calculation is recorded instead of the standard price calculation in the Part register.

If you use the Product configurator option, the following value is recorded when posting the transaction types Arrival – Purchase order and Delivery – Customer order in the sales company: Balance change x standard price saved on the order row.

It’s only the price alternative Standard price that posts the standard price from the order row, which is why it’s important to use this price alternative for these transactions. During remote configuration a calculation for the order row is not saved in the sales company. Only the standard price is saved, and the calculation itself is only saved in the production company.

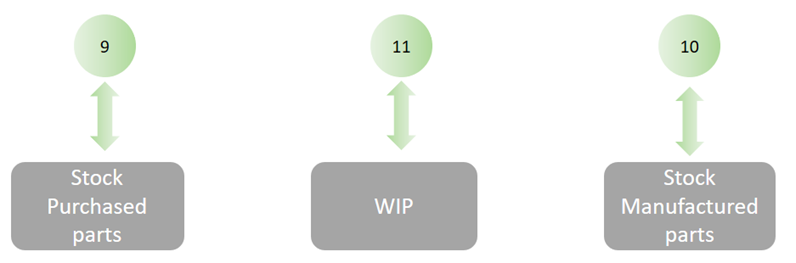

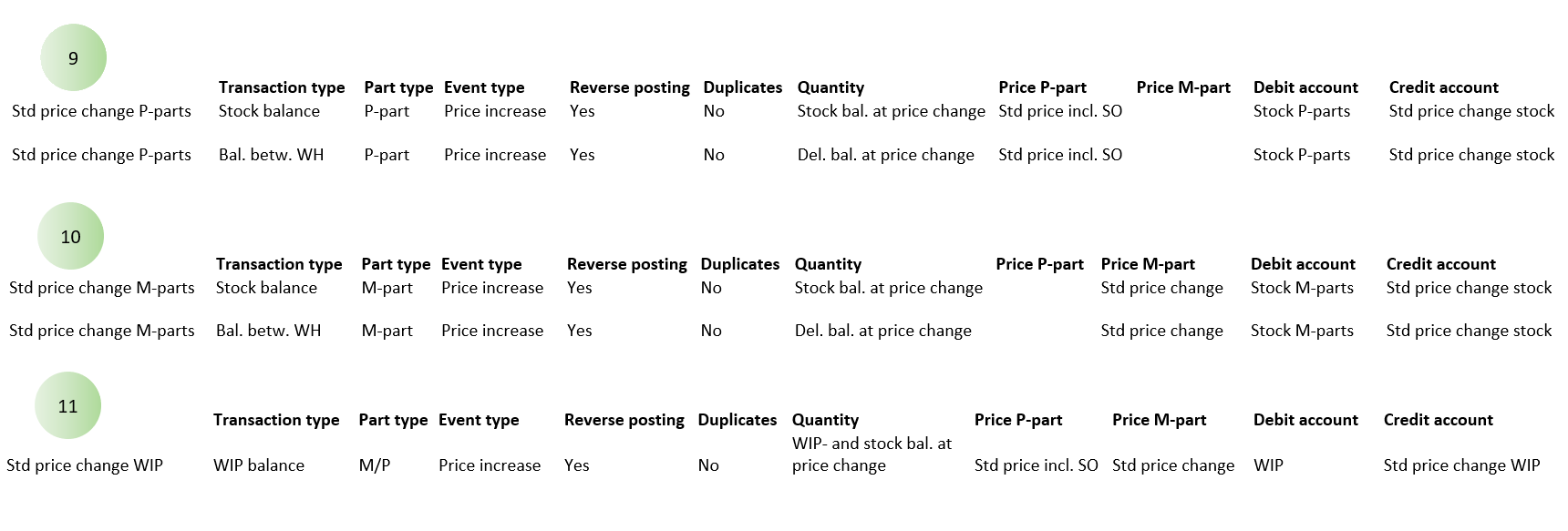

If parts in stock get new standard prices, the part's entire balance will be based on the new standard price. The change in stock must be adjusted in the accounting. Therefore, you must register coding methods for this purpose (item 9 and 10 below).

The recorded value regarding changes in stock (including the balance between warehouses) is normally: (New standard price – previous standard price) × stock balance

Since standard price changes also might affect the WIP value, an adjustment of the WIP value is made in the accounting (item 11 above).

The recorded value regarding adjustment of WIP value is normally: (WIP balance – "To stock" balance) × (new standard price – previous standard price)

In the table below you find an example of how to update posting methods for price change log according to the numbered arrows above. In the example, posting of standard prices are applied as well as SO mark-up for purchased parts. Separate stock accounts are used for purchased and manufactured parts. In the Part type field you select if the part is purchased, manufactured, or fictitious.

In addition to the option Management accounting![]() Management accounting is an option in Monitor ERP. It is used as a complement to the standard function called Stock accounting. The function means that all transactions on manufacturing orders (WIP value) are posted and transferred to the general ledger in the Accounting module in Monitor G5. The hours worked are recorded in the income statement, and provide a financial follow-up, for example, made per department and cost factor. Calculation differences are posted and these can be followed up per product, per order, etc. This function also contains extended management of cost of goods sold., the setting below, found under the Stock tab, must also be activated in order for item 11 to be posted.

Management accounting is an option in Monitor ERP. It is used as a complement to the standard function called Stock accounting. The function means that all transactions on manufacturing orders (WIP value) are posted and transferred to the general ledger in the Accounting module in Monitor G5. The hours worked are recorded in the income statement, and provide a financial follow-up, for example, made per department and cost factor. Calculation differences are posted and these can be followed up per product, per order, etc. This function also contains extended management of cost of goods sold., the setting below, found under the Stock tab, must also be activated in order for item 11 to be posted.

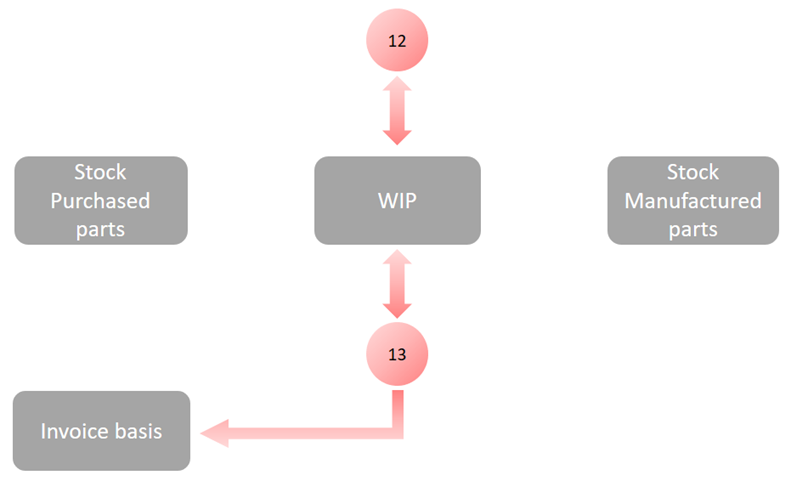

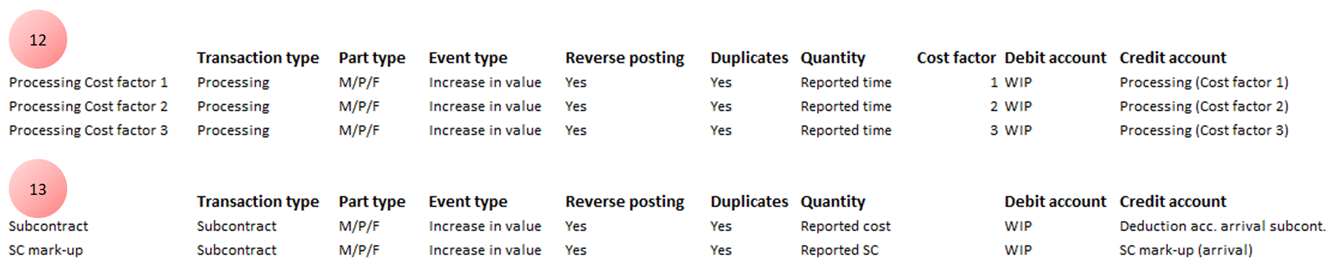

In this log, the processing cost and subcontracting cost on manufacturing orders are recorded. This also applies to subcontracting cost reported in the Report subcontract cost procedure. These posting methods handle the following stages of the flow (items 12-13 below):

The recorded value regarding transaction type Processing cost (12) above is the reporting's:

Time (setup time+unit time) × hourly cost for the work center

Regarding the time above, you can in the Quantity field choose the following alternatives:

- Reported time – When you select this alternative, the work will be recorded according to the operation’s actual reported time. When the order is reported as finished, a calculation difference regarding work may occur. This is then posted in the separate log for calculation differences.

- Planned time for reported quantity – When you select this alternative, the work will be recorded according to the operation’s planned time for the quantity that has been reported. In this case, no calculation difference will occur regarding work when the order is reported as finished.

Tip!

You will also find the alternatives mentioned above in the WIP value procedure. Make sure that the same alternatives are used on both places during reconciliation.

In the Cost factors field, you enter the hourly cost that should be used. That is, which cost factor(s) should be included in the value that should be posted. In Monitor you find up to three different cost factors that can be used. These can for example be divided into Direct salary expenses, Machine costs, and Manufacturing overhead. If you want to separate the cost for these (offset account for the WIP account), you must register more posting methods for the same reporting. This is made by using the same terms on these posting methods. However, Allow duplicates must be marked. You should also enter different cost factors and cost accounts for these posting methods.

For the transaction type Processing, you also select Price type. The available options are Reported and Current. Reported refers to the hourly cost that applied at the time of the reporting. Current refers to the current hourly cost for the work center. Here you should also make sure that the same alternative is used in the WIP value procedure.

The recorded value regarding transaction type Subcontract (13) above is one of the following alternatives (entered in the Quantity field):

- Reported cost – The actual subcontracting cost will be recorded according to the invoice price on the linked invoice that refers to subcontract purchase. For suppliers/work centers where the invoice is not linked, the price will instead be recorded from the purchase order in connection with the arrival reporting.

- Planned cost for reported quantity – The planned subcontracting cost will be recorded according to the price on the purchase order in connection with the arrival reporting. Please note the following for planned setup cost: For subcontract, the entire planned setup cost will be created in connection with the reporting of the first quantity.

Tip!

You will also find the alternatives mentioned above in the WIP value procedure. Make sure that the same alternatives are used on both places during reconciliation.

If you also want to valuate subcontracting cost including SC Mark-up, then you also need to create duplicates to the above-mentioned price alternative where you select one of the alternatives:

- Reported SC mark-up

- Planned SC mark-up

Planned cost before invoice has been linked

This setting is only available for Manufacturing order log and transaction type Subcontract. The quantity must also be set to Reported cost or Reported SC mark-up. If this setting is activated, the system books the planned cost upon arrival. The cost can be adjusted when the supplier invoice is linked, that is, when the actual cost is known.

In the table below you find an example of how to create posting methods for manufacturing order log according to the numbered arrows above. In the example, separate posting is applied for work cost and cost factor. The subcontracting cost is posted according to reported cost including SC mark-up.

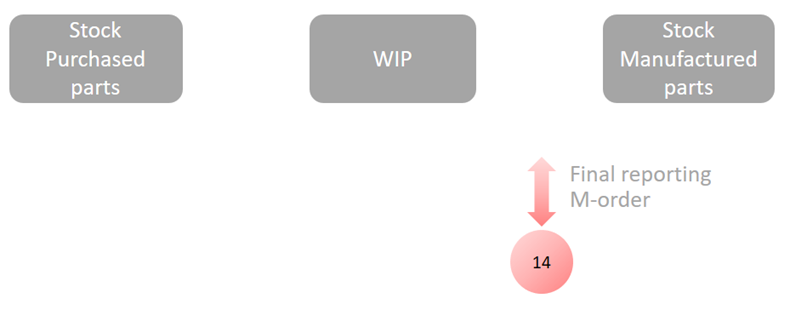

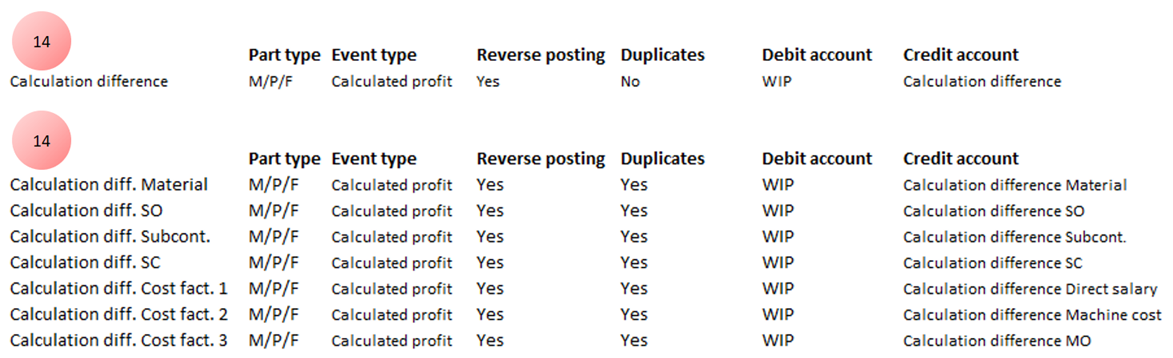

The calculation difference is recorded when the manufacturing order is final reported (receives status 9) in the Final reporting procedure in the Manufacturing module. These posting methods handles the following stages of the flow (item 14 below):

The calculation difference refers to the difference between the planned (pre-calculated) cost to manufacture one part and the reported (post-calculated) cost. The difference between these is recorded on the WIP account with offset account for calculation differences. There are two different ways to record these calculation differences:

- Total calculation difference – By using this alternative, only the total calculation difference for the order will be recorded. No separate calculation per calculation part will be made. This way to calculate calculation differences is only based on postings made on the WIP account for the current order. When the order is final reported, all postings made on the WIP account are totaled. A booking will be created on the WIP account and the calculation difference account, which makes the WIP value on the order zero.

- Separate calculation difference – By using this alternative, you will see the separate calculation difference per calculation part (material, work, subcontract, etc.). Here you must create multiple coding methods, one per calculation part. You must also check the box Allow duplicates. The calculation differences are determined by calculating the order's reported values per calculation part, and comparing these with the corresponding values in the standard price calculation (pre-calculated standard price).

For the calculation difference log you see warnings in the Posting box if incorrect account type has been selected for debit and credit.

In the table below you find two examples of how to update posting methods for calculation difference. In the first example, only the total calculation difference per order is recorded. In the second example, the separate calculation difference is recorded. The processing cost is shown with calculation difference per cost factor.

Read more about calculation differences in the section Final reporting of orders and calculation differences.

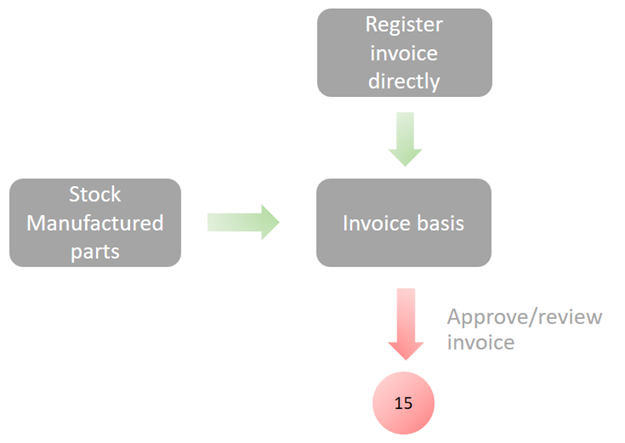

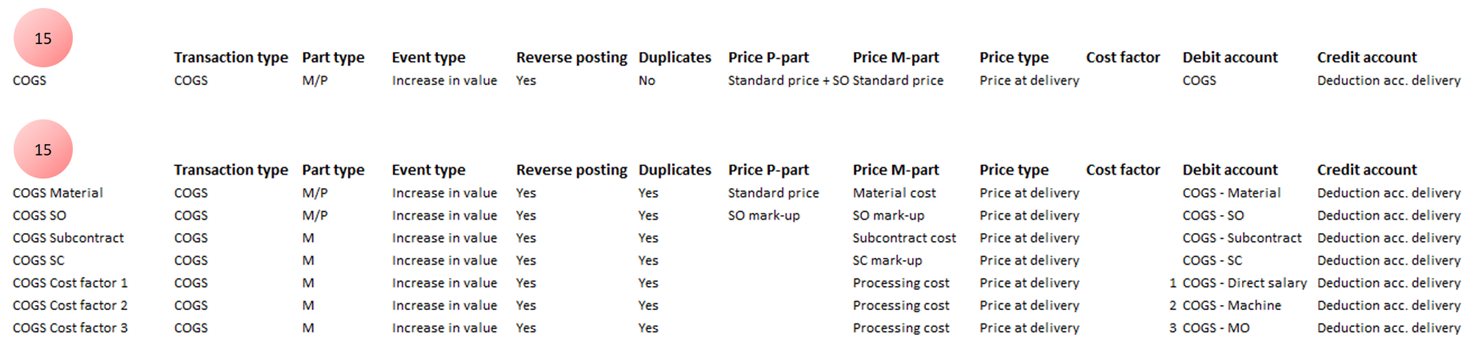

The invoicing log is recorded when the customer invoice is approved in the Review/Approve invoice procedure. These transactions can also be posted in the regular invoicing journal. However, by using Management accounting it is possible to determine the posting by using multiple terms. COGS (cost of goods sold) can also be recorded separated per calculation part. These posting methods handles the following stages of the flow (item 15 below):

During COGS, the sold goods' pre-calculated manufacturing cost (standard price) is recorded. If you post COGS by using Management accounting, this can be made in detail (separated per calculation part). COGS is normally posted on cost account with offset account clearing account delivery.

For the transaction type COGS, you also select Price type. You can choose one of the following alternatives Price at delivery and Price when invoicing. Price at delivery is recommended to make sure the same value is recorded during invoicing and delivery.

In the table below you find two examples of how to update posting methods for COGS. In the first example, only the total COGS is recorded. In the second example, the separate COGS is recorded per calculation part. The processing cost is also separated with COGS per cost factor:

In this log you can also record income. This is intended for special cases. When for example you want to determine posting of income in a more advanced way than in the posting matrix.

When you have installed the option Product configurator, the value that should be posted for COGS is loaded from the configured part's standard price/calculation. When a customer order is configured, a standard price and calculation which are unique for this order are saved.

When using the Product configurator option, the value for what will be posted for the transaction type COGS is loaded from the customer order row’s configured standard price in the sales company. When an order is remotely configured, a unique standard price is saved for this order row (although no calculation is saved, as this is only saved in the production company).

It’s only the price alternative Standard price that posts the standard price from the order row, which is why it’s important to use this price alternative for these transactions.