Other things to consider

Below you find a number of items which might be good to keep in mind. For example pitfalls to avoid.

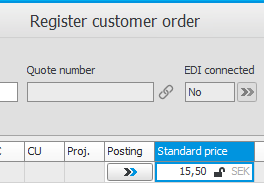

On customer order rows and invoice rows, there is a function where you can manually edit the standard price on the row.

On parts which are not stock updated, it is recommended that you do not use this function. This might cause a difference on the clearing account for delivery in cases where COGS is recorded in the customer invoice journal in the Sales module.

Under certain circumstances, a difference can occur on the clearing account for delivery/arrival. This happens when the reporting is done in the following order:

- Order is delivered

- Part gets new standard price

- Delivery is undone

At item 1, the part is posted at standard price on the stock account and the clearing account.

At item 2, the system adjust the stock account according to the price adjustment with the offset account standard price change.

At item 3, the part is posted back on the stock account and the clearing account, but with the now applied standard price. This will not cause a difference in the stock account, but in the clearing account. This is because the clearing account was debited according to one price and was credited according to another price. This difference corresponds to the standard price change. Before there is system support to handle this, it is recommended to manually post this difference on the account for standard price changes.

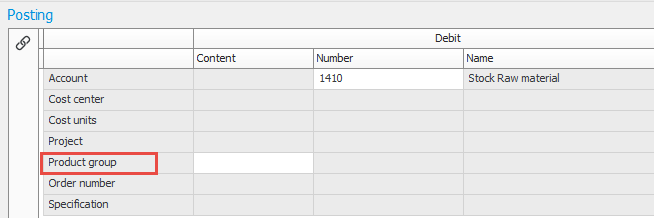

For posting methods it is possible to enter a dynamic posting on cost center etc. For example that the part's product group should be posted as cost center as seen below:

This requires that you also have registered a cost center per product group. It is not enough that the product groups are registered. The code of the product group must also be registered as cost center. If this has not been done, the system will post the transaction without cost center, without any signal of this. To prevent this, it is recommended to configure it mandatory to enter cost center for the account. This is done in the procedure Chart of accounts. In that case, the transaction will get stuck in the journal and cannot be approved before the cost center is registered.

There is another pitfall which might occur when you book cost center/cost unit via the part's product group, part code, etc. If this is done on balance accounts, for example the stock account, then no automatic adjustment will be made in the accounting if you change product group etc. for the part. Such a correction has to be made manually in the accounting.

When the option Management accounting![]() Management accounting is an option in Monitor ERP. It is used as a complement to the standard function called Stock accounting. The function means that all transactions on manufacturing orders (WIP value) are posted and transferred to the general ledger in the Accounting module in Monitor G5. The hours worked are recorded in the income statement, and provide a financial follow-up, for example, made per department and cost factor. Calculation differences are posted and these can be followed up per product, per order, etc. This function also contains extended management of cost of goods sold. is used, you need to final report manufacturing orders for the order to get status 9 (Historical) and for the calculation of difference to run. In connection with this booking, the remaining value will be removed from the WIP account, and is instead posted on account/accounts for calculation differences. Final reporting of orders is made in the Final reporting procedure in the Manufacturing module. Under Settings, under the Selection tab, it is also possible to enter a Final reporting date to decide which date the calculation difference should be recorded.

Management accounting is an option in Monitor ERP. It is used as a complement to the standard function called Stock accounting. The function means that all transactions on manufacturing orders (WIP value) are posted and transferred to the general ledger in the Accounting module in Monitor G5. The hours worked are recorded in the income statement, and provide a financial follow-up, for example, made per department and cost factor. Calculation differences are posted and these can be followed up per product, per order, etc. This function also contains extended management of cost of goods sold. is used, you need to final report manufacturing orders for the order to get status 9 (Historical) and for the calculation of difference to run. In connection with this booking, the remaining value will be removed from the WIP account, and is instead posted on account/accounts for calculation differences. Final reporting of orders is made in the Final reporting procedure in the Manufacturing module. Under Settings, under the Selection tab, it is also possible to enter a Final reporting date to decide which date the calculation difference should be recorded.

The list also shows warnings regarding reporting items which are not completed. Pay extra attention to reporting items regarding subcontract where no supplier invoice is linked. If you want to link the supplier invoice to the purchase order, then you cannot final report the manufacturing order.

It is possible to change the status of a final reported manufacturing order. This is useful if you for example need to adjust reporting items after the order has been final reported and the calculation difference is booked. If you have changed the status back, it is important to do the necessary adjustments as soon as possible, and then final report the order again. The system will then perform a new calculation of differences, and records this taking the earlier calculation of difference into consideration.