Reconciliation

At each monthly statement you should reconcile certain balance accounts in the accounting, that is, you should make sure the balance on the account in the accounting matches the corresponding value in the system. For Stock accounting![]() Stock accounting is a standard feature in Monitor ERP. It is used to continuously post all stock transactions in the system. This way the stock value in the Stock module matches the recorded value in the Accounting module. Changes in stock which are due to changed standard prices, direct stock reporting, arrivals and deliveries, stock count differences, nonconformities (cases), etc. will automatically be posted and give a better understanding of changes in stock and the company's gross profit margin in the income statement. and Management accounting

Stock accounting is a standard feature in Monitor ERP. It is used to continuously post all stock transactions in the system. This way the stock value in the Stock module matches the recorded value in the Accounting module. Changes in stock which are due to changed standard prices, direct stock reporting, arrivals and deliveries, stock count differences, nonconformities (cases), etc. will automatically be posted and give a better understanding of changes in stock and the company's gross profit margin in the income statement. and Management accounting![]() Management accounting is an option in Monitor ERP. It is used as a complement to the standard function called Stock accounting. The function means that all transactions on manufacturing orders (WIP value) are posted and transferred to the general ledger in the Accounting module in Monitor G5. The hours worked are recorded in the income statement, and provide a financial follow-up, for example, made per department and cost factor. Calculation differences are posted and these can be followed up per product, per order, etc. This function also contains extended management of cost of goods sold., the following reconciliations should be made:

Management accounting is an option in Monitor ERP. It is used as a complement to the standard function called Stock accounting. The function means that all transactions on manufacturing orders (WIP value) are posted and transferred to the general ledger in the Accounting module in Monitor G5. The hours worked are recorded in the income statement, and provide a financial follow-up, for example, made per department and cost factor. Calculation differences are posted and these can be followed up per product, per order, etc. This function also contains extended management of cost of goods sold., the following reconciliations should be made:

- Stock value – Stock account

- Invoice basis – Purchase – Clearing account for arrival

- Invoice basis – Sales – Clearing account for delivery

When using Management accounting, you should also reconcile the following account:

- WIP value – WIP account

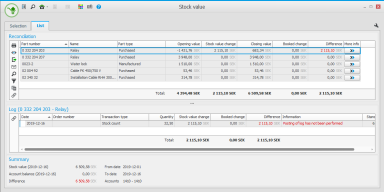

Here you reconcile the stock value in the Stock value procedure with the booked balance on stock accounts in the accounting module. You use the list type Reconciliation in the Stock value procedure for this reconciliation.

At the bottom of the window you see the stock account's closing balance at the end of the selected period. This is compared with the corresponding value of the stock value list. A comparison is made between the stock change and the corresponding recorded change in the accounting. This is made for the selected time period. This information is shown as a total per part and helps you to see which parts causes differences, if any.

If you have several stock accounts, you should reconcile one stock account at a time. The stock account is entered under settings below.

Then enter the period to reconcile in the field Reconciliation period. If it is the raw material stock you want to reconcile, and SO mark-up is handled for Purchased parts, the you might also need to check the setting Include SO mark-up.

In the upper part you enter the selection of the parts you wish to include in the stock reconciliation:

Here it is important to do a selection corresponding to the parts recorded on the stock account entered under Settings in the Account field. If you for example want to reconcile the account for raw material stock, it might be good to select by the part type Purchased parts. If you want to reconcile a stock account which corresponds to a certain warehouse it means you also have to choose warehouse on the toolbar. You might also have to do a selection using other terms, such as product group or part code, in cases where the posting is determined with the help of these terms when posting on the stock account in question.

In the Reconciliation box you will see opening stock value and closing stock value for the period and also its change. This is compared to the recorded change. If there is a difference, details can be shown in the Log box.

In the Log box you see a detailed log for the part which is marked. Here you can see, on transaction level, if the log record has a difference and you can in that case also see the cause of the difference.

In the Summary box you will for example see the stock value at the end of the period and the balance on the stock account.

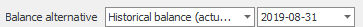

The following applies if you wish to do a manual reconciliation of stock value against the accounting in list type Detailed or Total, and at a certain date in past time in the procedure Stock value. Use the Balance alternative called Historical balance (actual date).

Also check the setting Historical price under price alternative for purchased and manufactured parts.

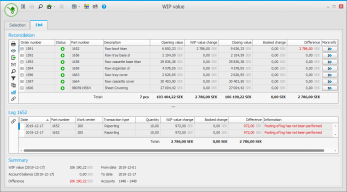

Here you reconcile the value in the WIP value procedure in the Stock module, with the booked balance on the WIP account in the Accounting module. You use the list type Reconciliation in the procedure WIP value for this reconciliation.

At the bottom of the list you see the closing balance on the WIP account at the end of a period. This is compared with the corresponding WIP value. A comparison is made between the WIP change and the corresponding recorded change in the accounting. This is made for the selected time period. This information is shown as a total per order and helps you to see which orders cause differences, if any.

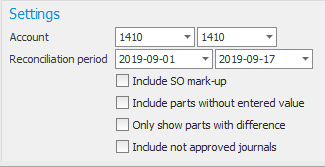

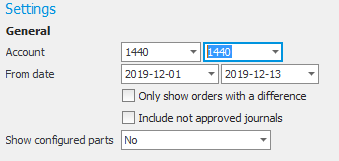

If you have several WIP accounts, you should reconcile one WIP account at a time. You enter the PIA account under the settings below.

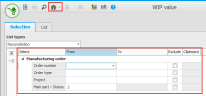

Here it is important to do a selection corresponding to the orders recorded on the WIP account entered under Settings in the Account field. If you want to reconcile a WIP account which corresponds to a certain warehouse it means you need to choose warehouse on the toolbar. You might also have to do a selection using other terms, such as order type or project, in cases where the posting is determined by these terms when posting on the WIP account in question.

Then enter the period to reconcile in the field Reconciliation period. With the setting Only show orders with a difference you decide if only orders with a difference should be included in the list. With the setting Include not approved journals you decide if journals which are not yet approved, should be included in the list. With the setting Show configured parts you decide if configured parts should be shown in the list. Please note! The system does not support reconciliation of WIP value of configured parts. The Product configurator is an option you can add to the system.

In the upper part you enter the selection of the orders you want to include in the WIP reconciliation:

In the section Internal operations, the settings should correspond to the settings you made for posting of processing in the manufacturing order log in the procedure Register posting method.

In the section Subcontracts, the settings should correspond to the settings you made for posting of subcontract in the manufacturing order log in the procedure Register posting method. If the setting Planned cost before invoice has been linked is activated, the system books the planned cost upon arrival and the cost is adjusted when the supplier invoice is linked, that is, when the actual cost is known.

In the Reconciliation box you will see opening WIP value and closing WIP value for the period, and also its change. This is compared to the recorded change. If there is a difference, details can be shown in the Log box.

In the Log box you see a detailed log for the orders which is marked. Here you can see, on transaction level, if the log record has a difference and you can in that case also see the cause of the difference.

In the Summary box you will for example see the stock value at the end of the period and the balance on the WIP account.

The list will by default included orders with the status In progress (3), which is the normal valuation method. Please note! Manufacturing orders need to be final reported to give the finished orders the calculation difference and the final offset posting of the WIP value to be posted. If these manufacturing orders are not final reported, then they will remain as WIP value in the accounting and cause a difference against the list type WIP value. Read more about this in the section Final reporting of orders and calculation differences.

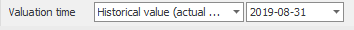

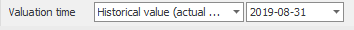

Here you reconcile what is arrival reported but not linked to invoice (Invoice basis – Purchase), against the booked balance on the clearing account for arrival in the Accounting module. The clearing account is credited in connection with arrival and is debited in connection with linking the supplier invoice. Normally, posting is made at standard price. The clearing account which should be reconciled should be entered on the Account row under the Selection tab. Then choose the Price alternative called Historical standard price. If purchased parts are valuated including SO, then you should also activate the setting Include SO for P-parts. Then enter which date should be reconciled. This is done by selecting Historical balance (actual date) for the setting Valuation time.

You then reconcile the value in the list with the recorded balance on the account in the accounting.

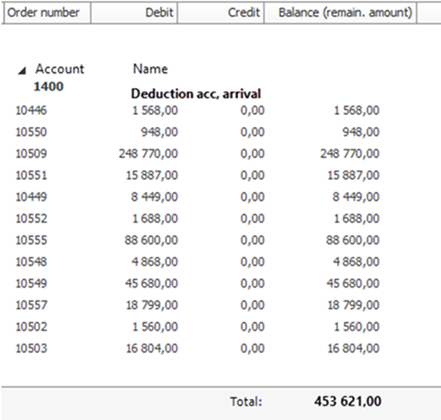

If differences occur, you can reconcile this list (total per order) with the "open" orders on the account in the accounting in the list called Reconciliation of open entries in the Voucher list procedure.

If you are using the option Management accounting, then you can also use the list to reconcile the clearing account for subcontract. Please note! This is only possible if subcontracts are valued at Planned time for reported quantity or if the setting Planned cost before invoice has been linked is checked when valuation takes place for Reported cost. You find the setting regarding posting of subcontracts in the procedure Register posting method. It is posting methods with transaction type subcontract for the manufacturing order log that are concerned.

Here you reconcile what is delivery reported but not invoiced (Invoice basis – Sales), against the booked balance on the clearing account for delivery in the Accounting module. The clearing account is debited in connection with delivery and is credited in connection with invoicing. Normally, posting is made at standard price. The clearing account which should be reconciled should be entered on the Account row under the Selection tab. Then choose the Price alternative called Historical standard price. If purchased parts are valuated including SO, then you should also activate the setting Include SO for P-parts. Then enter which date should be reconciled. This is done by selecting Historical balance (actual date) for the setting Valuation time.

You then reconcile the value in the list with the recorded balance on the account in the accounting.

If differences occur, you can reconcile this list (total per order) with the "open" orders on the account in the accounting in the list called Reconciliation of open entries in the Voucher list procedure.

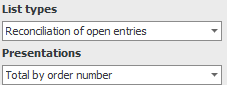

You use the Voucher list procedure in the Accounting module to reconcile open records. If you in the Chart of accounts procedure have activated posting on order number on the balance accounts, you can in this list find which records in the accounting have a balance left on the account per order. Use the list type Reconciliation of open entries with the presentation Total by order number. Then select by account and enter to which voucher date reconciliation should be made. You can manually match this list for example with invoice basis, WIP value, and so on.