Incoming payment of advance invoice

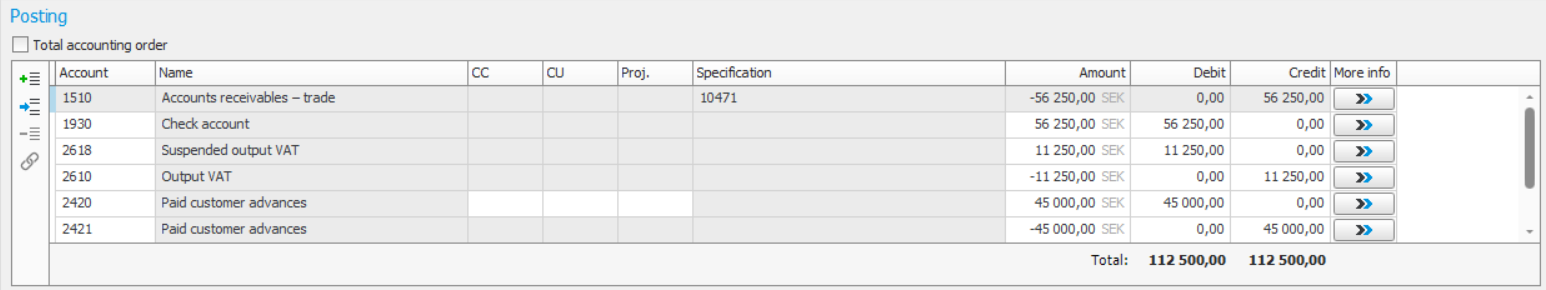

When the incoming payment is received, a check is made to see if the paid invoice refers to an advance invoice. If the system settings Handle suspended VAT during payment of advance invoice and Use separate accounts for invoiced and paid advances are activated, then an extended posting will be made in comparison with a normal incoming payment.

The VAT amount will then automatically be posted from the account for suspended VAT to the account for output VAT. In addition, the advance amount will be shifted from the account for unpaid advances to the account for paid advances.

If the Basis for VAT report is loaded from system setting has been set to VAT code in general ledger transactions, the following applies: When paying an advance invoice a VAT code is entered on the posting row regarding paid advances. The VAT code is loaded from the invoice being paid. This results in a correct accounting of turnover in connection with when the VAT accounting loads the basis for the VAT report via VAT code on general ledger transactions.

If the system setting is set to load VAT code in chart of accounts, the VAT code will be used according to the setting of the account, when you do not consider the VAT code of the transaction. In order not to create differences in the VAT accounting, the account for paid advances is linked to the VAT row for turnover liable to VAT.