Self-billed invoice (Purchase)

A self-billed invoice is an invoice created by the buyer instead of the supplier. It is used when the buyer issues the invoice on behalf of the supplier, typically because the supplier does not issue one themselves. This is commonly used in foreign purchase transactions when buying from overseas suppliers who are not registered in Malaysia and therefore do not issue LHDN-compliant invoices.

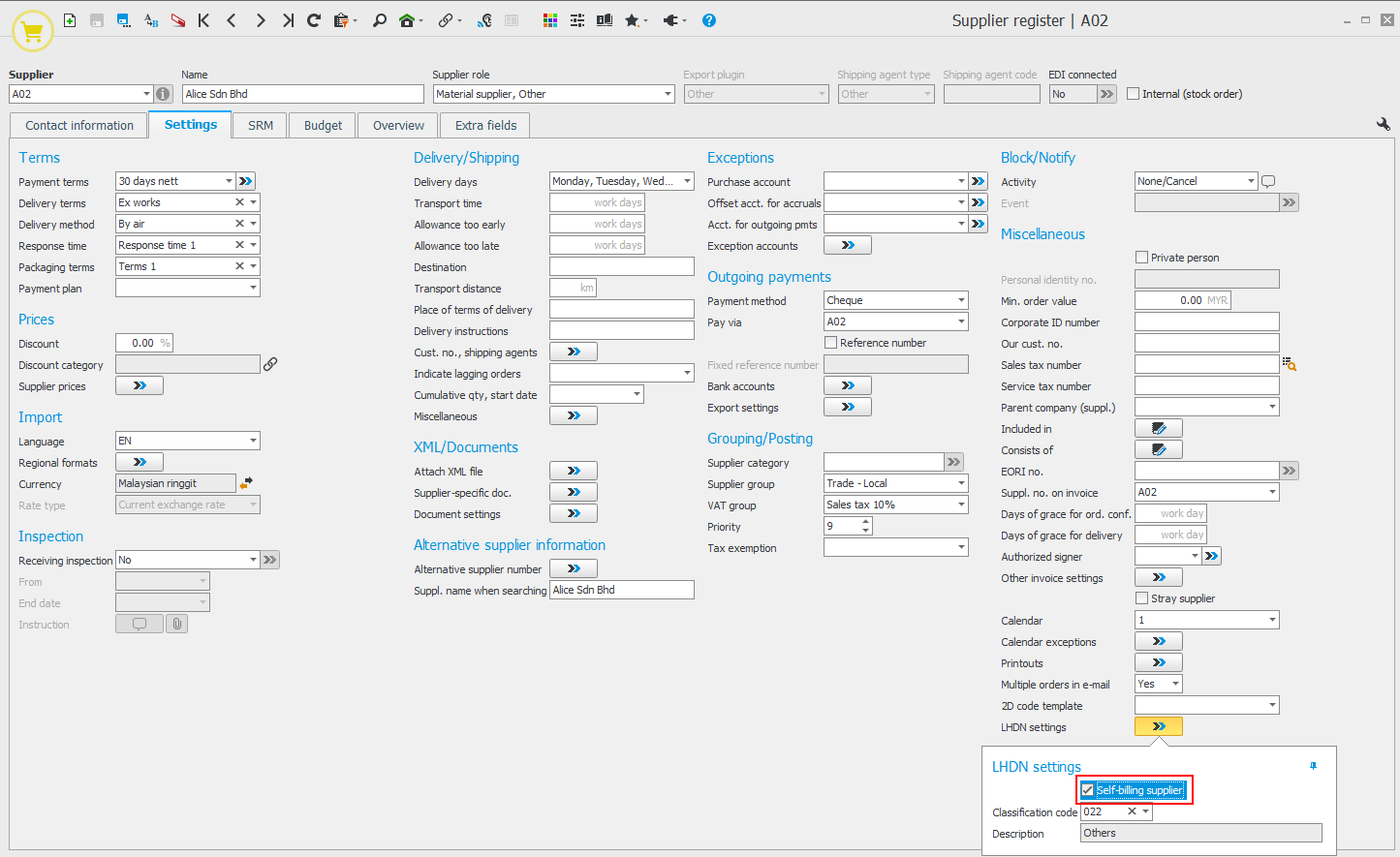

The Self-billing supplier checkbox in the Supplier register procedure determines whether a self-billed invoice should be uploaded to the MyInvois portal.

If the invoice not should be uploaded to the MyInvois portal, the checkbox Self-billing supplier must be unchecked.

If the invoice should be uploaded to the MyInvois portal, the checkbox Self-billing supplier must be checked. After you have final recorded the invoice in the Register supplier invoice procedure, you should upload it later in the LHDN approval procedure.