Other settings for LHDN

You will need to check a number of other settings according to the instructions below before LHDN e-invoicing can be used.

In the VAT settings procedure, the VAT codes tab includes two important columns for LHDN e-Invoicing integration: ISO code and LHDN Tax type. Here you can configure the tax classification depending on your integration method.

ISO code

The ISO code is used when sending e-invoices via Crediflow. It defines the tax category according to international standards used in the Peppol format.

LHDN Tax type

The LHDN Tax type is used only for Direct API integration with LHDN (MyInvois portal). You must select the appropriate tax type for each VAT code to comply with the LHDN requirements.

In the Countries procedure you must ensure that the address formats are correctly set to comply with the LHDN standard.

It is necessary to set the address format for Malaysia (MY) to City + State/Region + Zip code.

For other active countries, the address format can be either City + State/Region + Zip code or Zip code + City.

In the Currencies procedure you must ensure that all currencies follow the ISO-4217 format to comply with the LHDN standard.

You can find the full list of supported currency codes on the LHDN website.

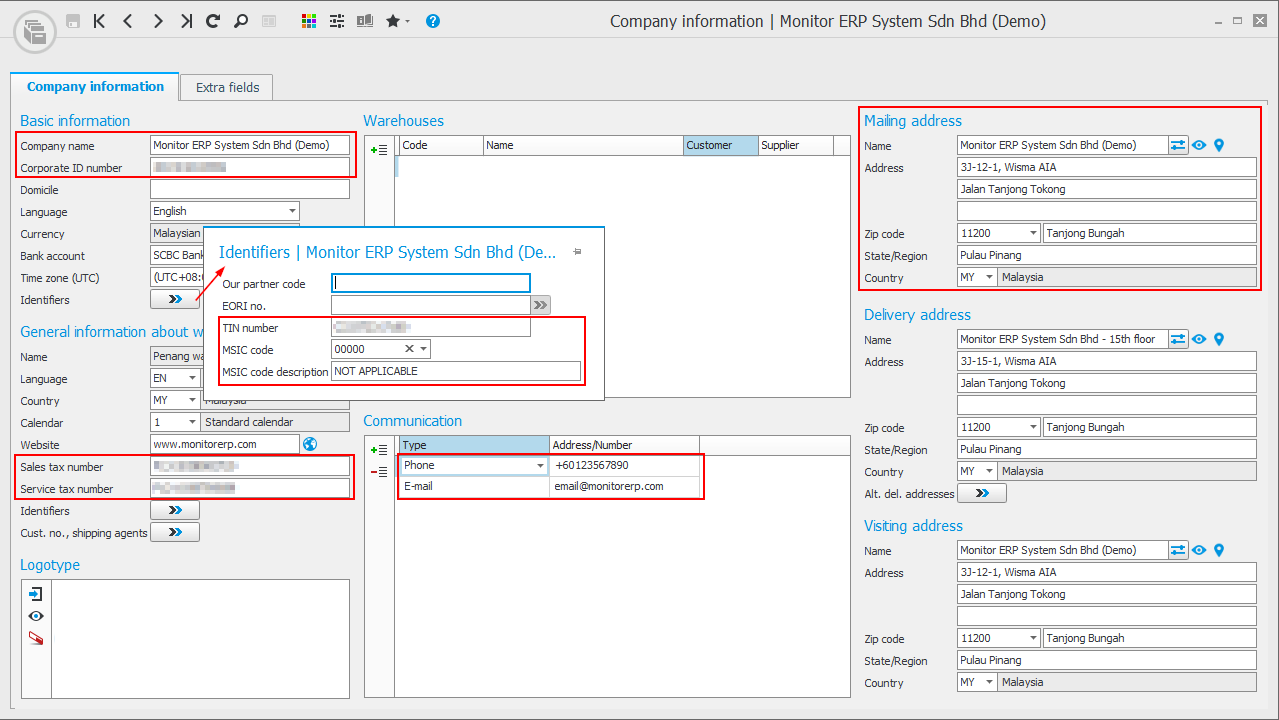

The information used for the SupplierParty (in LHDN sales invoices) and the BuyerParty (in LHDN self-billed invoices) is loaded from the Company information procedure.

LHDN e-Invoicing requirements

To comply with LHDN e-Invoicing requirements, the following fields are mandatory:

- Company name

- Corporate ID number – here you enter the company’s new Business registration number (BRN).

- TIN number

- MSIC code

- Sales tax number / Service tax number – here you can enter the company’s SST registration number. It can be either the sales tax number or service tax number, or both.

- Phone number – here you enter the company’s phone number follow the E.164 format, without dashes (-), slashes (/) or spaces.

- E-mail address

- Mailing address – here you enter the mailing address and must follow the format: City + State/Region + Zip code.

The information used for the BuyerParty (in LHDN sales invoices) is loaded from the Customer register procedure, whereas the information used for the SupplierParty (in LHDN self-billed invoices) is loaded from the Supplier register procedure.

LHDN e-invoicing requirements

To comply with LHDN e-invoicing requirements, the following fields are mandatory:

- Customer name or Supplier name – here you enter the name of the customer or supplier as it should appear on the invoice.

- Mailing address – here you enter the customer’s or supplier’s mailing address according to the format configured in the Countries procedure.

- Personal identity number – here you enter the customer’s or supplier’s MyKad / My Tentera / Passport number / MyPR / MyKAS identification number if the customer or supplier is an individual (private person).

- Corporate ID number – here you enter the customer’s or supplier’s new Business registration number (BRN) if the customer or supplier is a business entity.

- TIN number – here you enter the customer’s or supplier’s TIN number.

A valid TIN number must be provided. If the TIN is not available or not provided, you may use a General TIN provided by LHDN.

- Private person without TIN: EI00000000010

- Foreign Buyer without TIN: EI00000000020

- Foreign Supplier without TIN: EI00000000030

- Government / Local or State authority TIN: EI00000000040

- Sales tax number / Service tax number – here you enter the customer’s or supplier’s SST registration number. It can be either the Sales tax number or Service tax number, or both.

- References – here you enter the customer’s or supplier’s contact reference name and phone number. The phone number must follow the E.164 format, without dashes (-), slashes (/) or spaces.

The ISO code for units can be found in the Basic data![]() With "basic data" we refer to the static records in a database, for example parts, customers, users, work centers, etc. – Part procedure under the Units tab. You can also modify, add, and delete ISO codes under the ISO codes for Units tab.

With "basic data" we refer to the static records in a database, for example parts, customers, users, work centers, etc. – Part procedure under the Units tab. You can also modify, add, and delete ISO codes under the ISO codes for Units tab.

You can see the full list of supported ISO codes for Units on the LHDN website.

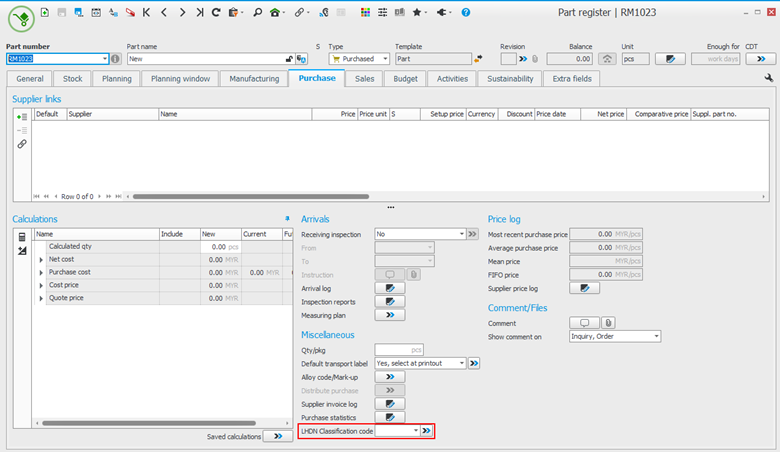

The LHDN classification code is a standardized code used to classify the type of goods or services involved in a business transaction. It is part of the mandatory data required by Malaysia’s e-invoicing system as defined by LHDN. In Monitor ERP, you can assign the LHDN classification code for each part in the Part register procedure, under the Sales and Purchase tab.

For expense invoices received from self-billing suppliers, the LHDN classification code is configured in the Supplier register procedure.

It's important to ensure all required fields are completed accurately to avoid validation errors when uploading e-invoices to LHDN.