Sales/Retirement of assets

You use this procedure in connection with when you need to sell or retire fixed assets. In connection with this, the fixed asset will get status Sold/Retired, at the same time as the system removes the asset's value from the balance sheet. Any profit or loss will also be posted. A sale can create a depreciation from the most recent depreciation up to and including the sales date.

If the sale concerns a main object you can choose if the linked sub-objects should be included in the sale/retirement. The sub-objects that are not included in the disposal/sale become disconnected from the main object. A sub-object can for example be an associated component that is a part of a larger machine (main object).

It is possible to sell/retire part of the fixed asset. The fixed asset will then remain as active in the register but with a reduced acquisition value and accumulated depreciation/residual value.

In the Sales module you can sell fixed assets by entering them on order rows/invoice rows. You can access this function if your user has sufficient user rights to sell/retire fixed assets. In connection with approving the invoice, the sales/retirement will automatically be registered in the fixed assets register and bookkeeping basis for this is created.

Sales/retirement of fixed assets is also handled in other procedures:

- Fixed assets list – Here you can print a list/register.

- Register fixed assets object – Here you see information about the fixed assets.

- Undo depreciation/sales – Here you can undo sales/retirement.

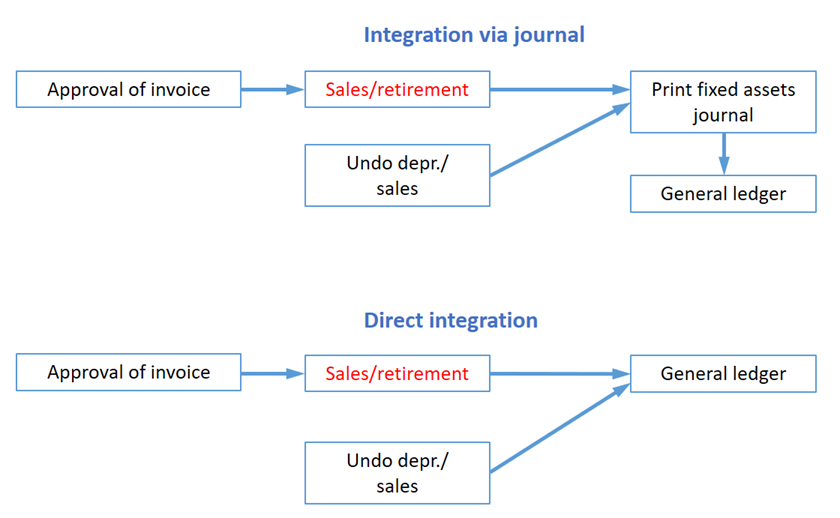

- Print fixed assets journal – Here you record postings (when using direct integration this will take place directly when you save in this procedure).

A warning will appear if the fixed assets journal is not linked to a voucher number series. This is handled in the Voucher number series/Journals procedure.