Invoicing

The invoice document

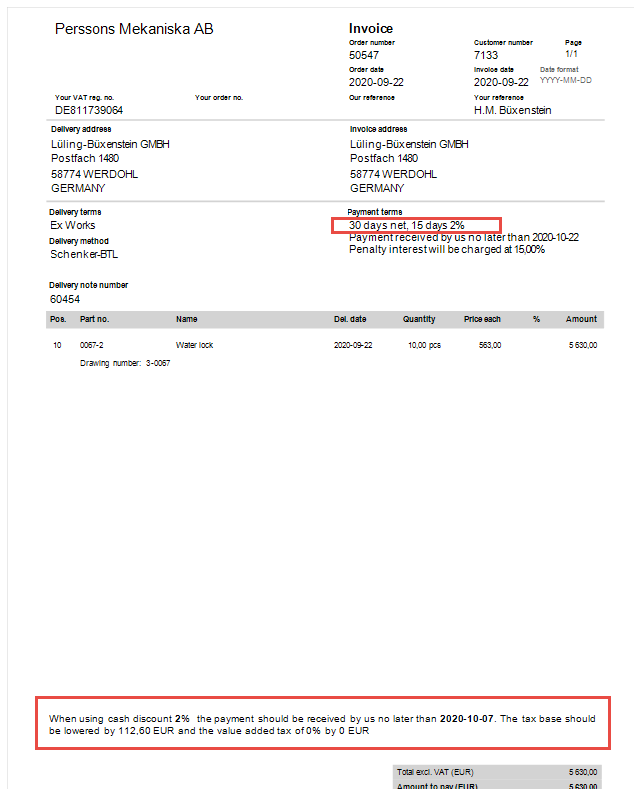

When you give a cash discount, information about this is shown on the sales documents such as order confirmations, invoices, etc. The information shown is the name you gave the payment term. On the invoice document you will also see additional information about what day the payment should be received in order for the customer to get the cash discount. Information about lowered tax base and VAT is also displayed (depending on whether the basis for the cash discount is based on the gross or net amount). This information is shown for each cash discount limit.

Please note! Cash discount is not handled for credit invoices, interest invoices, internal invoices, and cash receipts.