Revenue calculation

The intended way of working is to create and save the revenue calculation at the very end of each month after all invoices are recorded and after recording items/reporting items which may affect the project and its calculation are all completed. Then you print the revenue calculation journal with a voucher date on the last of each month. It is always the profit mark-up that is used for the revenue calculation.

Managing advance payments – Recommendation when using the Percentage of completion method

We recommend that you record advance payments for projects where you work with percentage of completion against the income statement. The actual revenue calculation takes into consideration if the advance is posted in the income statement or in the balance sheet. On the result in the project register (also in the project follow-up) where you have recorded the advance on a balance account, both the advance and the recorded profit according to the revenue calculation will be shown as income in the result.

In other words, it will be regarded as double income as long as the advance payment remains on the balance account.

The recommendation is to record the advances via the income statement for the projects where you apply PCM because of what is explained above regarding how it is displayed in project register/project follow-up. However, there is functionality making it possible to take into consideration if there are advances recorded in the balance sheet.

- Remaining advances recorded in the balance sheet are taken into consideration.

- In the revenue calculation you see information about existing advances recorded in the balance sheet.

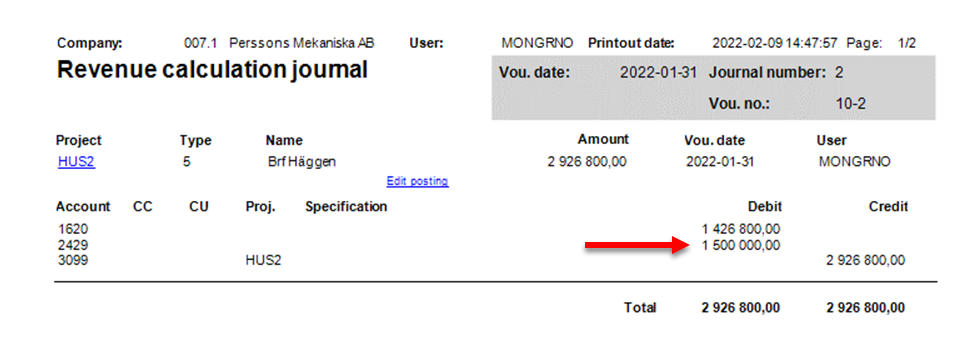

- There is an extra standard account for recording the revenue calculation to make the balance sheet total correct. This way you avoid recording directly on the advance account which can be linked to the VAT report, if suspended VAT is activated for advances in the system. The standard account called Offset account for advances booked on balance sheet (PCM calculation) is available under the Accounting tab together with other standard accounts regarding PCM.

Offset account for advances booked on balance sheet (PCM calculation) is used for recording of revenue calculation in order to take remaining advances in the balance sheet, if any, into consideration.

In the example below, an advance of EURO 499,200 is recorded in the balance sheet. The stage of completion is set to 67%, so the recognized income og EUR 670,000 is posted as income in the income statement. However, the posting in the balance sheet will be divided as shown in the image below.

The advance is recorded on account 2420, but that account is linked to the VAT report which should not be affected by the revenue calculation. That is why the advance should be recorded on account 2429 instead. The difference, if any, is recorded as debt on the relevant standard account, in this example it is account 1620.

Calculate revenue for projects

Use the Revenue calculation procedure and the General list type to do the revenue calculation.

In that procedure you decide the projects for which you want to execute the calculations, via the Selection tab. There are additional selection rows in the backstage of the procedure. You can choose to look at certain projects or project types at a time, and save each calculation separately, and then print the journal for all of them afterwards. You can redo the calculation as long as the journal is not reset.

Only projects with status 3 (In progress), and with the Revenue calculation method selected for the project type, are shown in the list.

Settings

Select to (and including) which period the calculation should be made. The current period is suggested by default. Select if the calculation should be based on the actual date or the log date of the reporting. The calculation is based on log records and invoices with voucher date/invoice date to and including the selected period. That is why it might differ a bit in relation to values in the project register which always displays current values.

You can also choose if budget should be shown and if you want to pre-select the Include checkbox for all projects to use when saving.

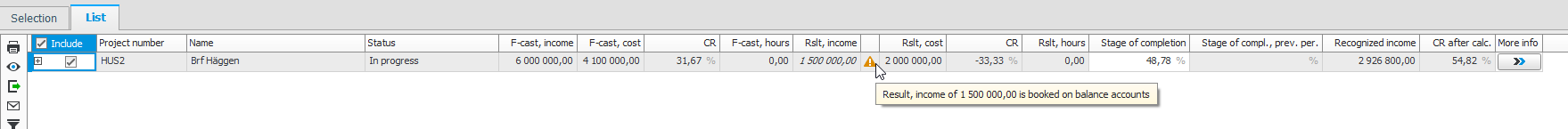

The list

At the top of the list you see the projects which you should take a closer look at. They can have a stage of completion which falls outside the 0-100% interval or a loss if you are using fixed price. These projects are shown together with a warning with information in a tooltip and in the validation window.

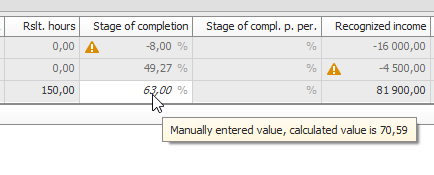

If the stage of completion falls outside the interval of 0 - 100%, the warning will change into a validation if the project is marked with Include. You must adjust the forecast making the stage of completion fall within the allowed interval before the project in question can be saved. If the system setting called Editable stage of completion in the Revenue calculation is activated, you also manually adjust the percentage.

By clicking the More info button  you can show additional columns the list. Drag the columns you want to the place in the list where you want to them and save the layout. This way they will be in the same place the next time you open the procedure.

you can show additional columns the list. Drag the columns you want to the place in the list where you want to them and save the layout. This way they will be in the same place the next time you open the procedure.

If you use main projects/sub-projects and have selected that calculation should be made on main level, you can use the drilldown function to see underlying projects and values for the calculation.

What can be edited in the list?

When a project is marked with Include, it is possible to edit forecast values and the stage of completion (if the corresponding system setting has been activated). These changes will affect the calculation of the stage of completion and the calculated recognized income.

Please note! When saving, the forecast in the Project register is automatically updated for the project in question. Please note! The project will be removed from the list as soon as you save. However, you can always load it again for the same period as long as the journal has not been reset.

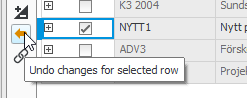

If you want to undo edited forecast values, you should mark the row and reset the forecast values by clicking the Undo changes for selected row button on the function menu. After you have saved your changes you can no longer reset the forecast values. In that case you need to change them manually after you have again loaded the project in the list.

In the list you will see a separate column presenting the project's stage of completion for the previous period. If the stage of completion is displayed in italics, it means it was manually edited in the previous period. If you place the cursor over the value, you will see the calculated stage of completion in a so-called tooltip.

The calculated recognized income is shown in the Recognized income column. You will also see the CR![]() The contribution ratio (CR) is the portion of the invoice amount (sales price) that the contribution margin represents. CR is entered as a percentage. in % after the deduction which can be compared to the CR in the forecast and budget in order to determine the reasonability.

The contribution ratio (CR) is the portion of the invoice amount (sales price) that the contribution margin represents. CR is entered as a percentage. in % after the deduction which can be compared to the CR in the forecast and budget in order to determine the reasonability.

The projects you marked with Include and that you save are the ones that will be shown in the journal for transfer to the accounting.