VAT settings

This is a central procedure used to determine how VAT should be managed in the system. In this procedure you can:

- Register VAT groups – these are used on customers, suppliers, and invoices to determine which VAT code should be suggested on order rows and invoice rows.

- Register VAT codes – these are used on orders, invoices, and posting rows to determined which VAT rate, VAT posting, etc. should apply to the row.

- Register exceptions – for VAT codes per product group.

Different VAT groups and VAT codes are included in the system depending on in which country the system is installed.

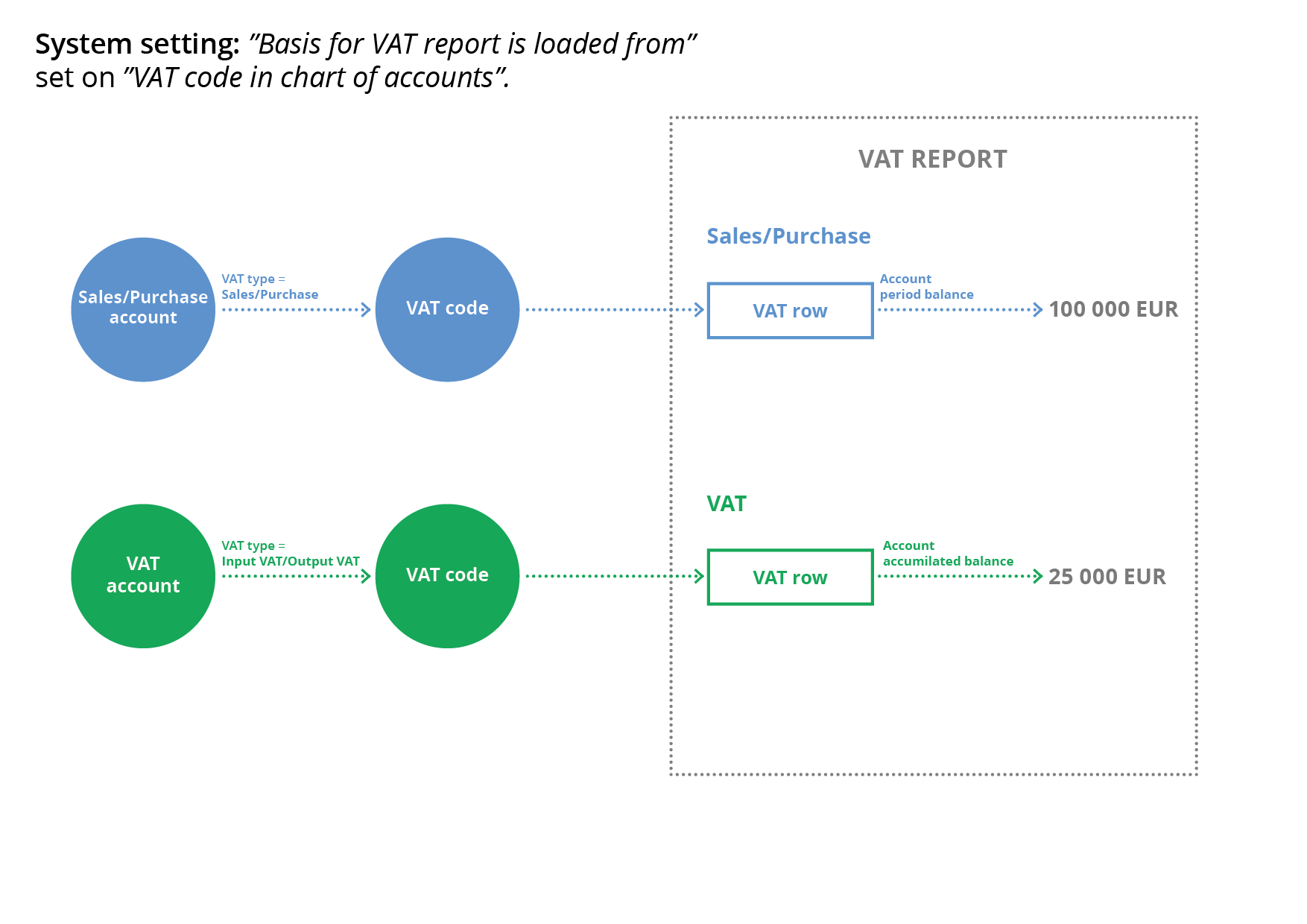

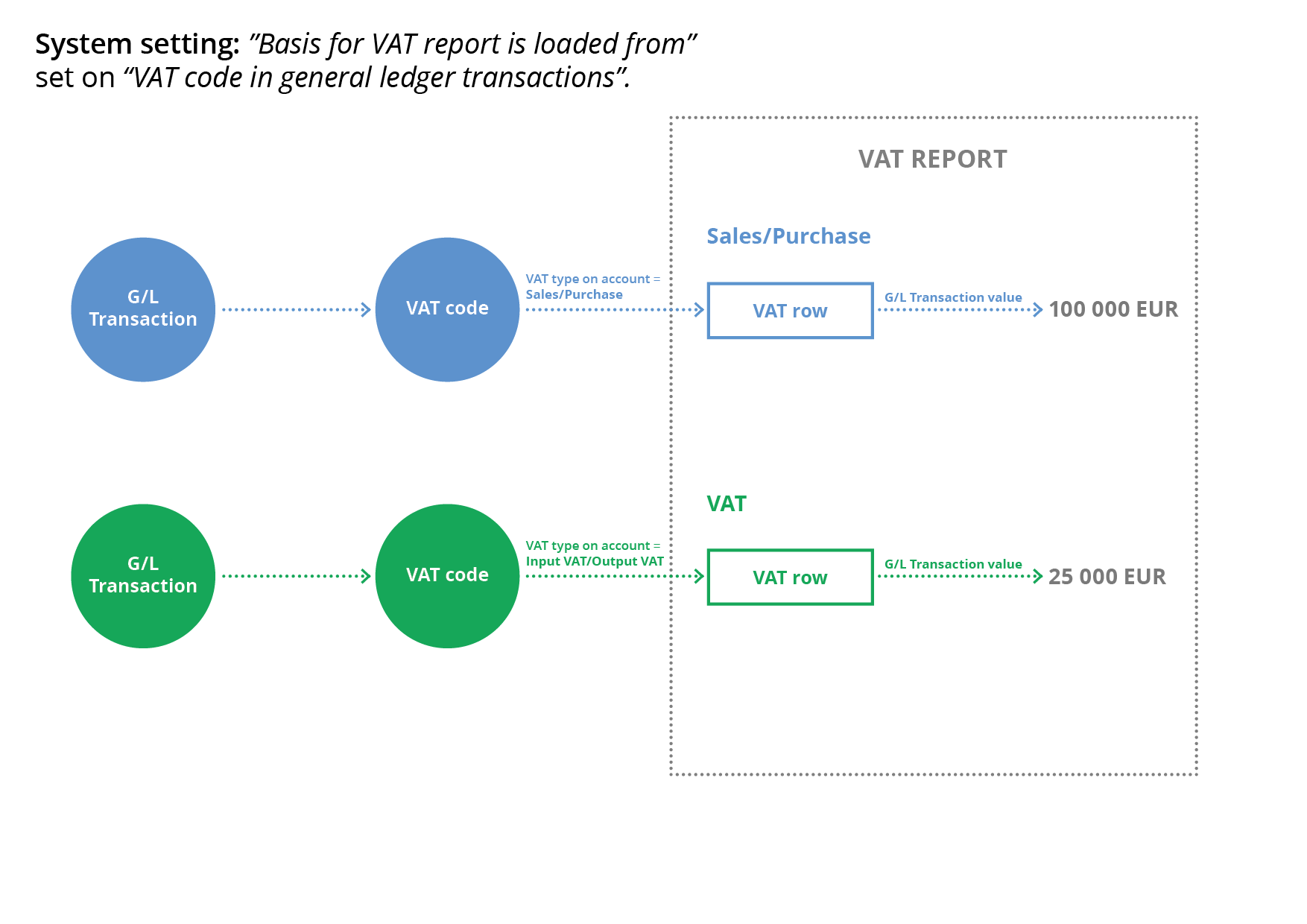

Depending on how the Basis for VAT report is loaded from system setting has been configured, the VAT report works in different ways. The difference is explained in the schematic illustrations below: