Interest invoicing

In the following topic it is described how interest invoicing works in Monitor ERP and what settings you need to configure before the company can start applying interest invoicing.

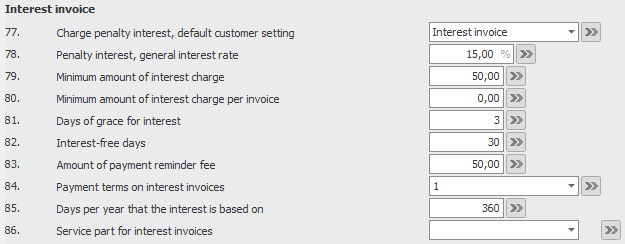

System settings

There are a number of different system settings regarding interest invoicing which you need to review. You find these settings under the heading Interest invoice, under the Sales tab in the System settings procedure. Some of the settings have a default value. Please read the description of these system settings in the online help function for that procedure.

- Create a product group for interest (call it, e.g., "Interest") and select the sales account for penalty interest 8313 (in Sweden) for all customer groups. This is done under the Product group and Sales account tab in the Posting matrix procedure.

- Select VAT code 4 (VAT exempt) for the product group for all customer groups. This is done under the Exception per product group tab in the VAT settings procedure.

- Create a part of the Service type (call it, e.g., "Interest") and choose Unspecified as Service type. Assign the part the product group you created earlier. This is done in the Part register procedure.

- Finally, select this service part in the above mentioned system setting.

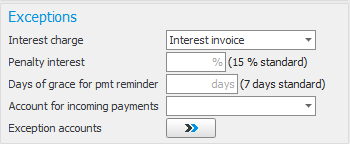

Customer register

For some of the above mentioned system settings it is possible to make exceptions per customer. You find these in the Exceptions box, under the Settings tab in the Customer register procedure. If a setting here is empty (no alternative has been selected), it means the system setting applies. But if you enter/select a setting, this will override the corresponding system setting when interest invoicing to that customer in question.

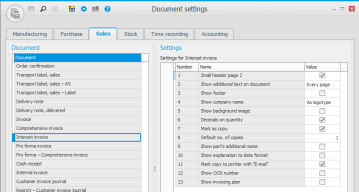

Document settings

For interest invoices there is a document template called Interest invoice in the Document settings procedure. You need to review the settings of this document template. Read more about these settings in the Settings topic.

Interest charge in Incoming payments

You can automatically receive suggestions from the system in the Incoming payments procedure, that the charging of interest to customer should be made using an Interest invoice or should be done on the Next regular invoice, for a payment which has been made too late. For this to happen, it is required that one of these two methods for interest charge has been selected for the customer in question.

The system checks if the accounts receivable record, has any of the methods for interest charge selected (this is loaded from a setting on the customer). Then the system settings Days of grace![]() The term days of grace (or grace period) is used at requirements planning in order to calculate rescheduling of actual orders that cover the requirement but that are too late in time, instead of suggesting a new order. for interest, Interest-free days, and Minimum amount of interest charge per invoice will determine if interest charge should be suggested according to any of the two methods. Otherwise No charge will be suggested.

The term days of grace (or grace period) is used at requirements planning in order to calculate rescheduling of actual orders that cover the requirement but that are too late in time, instead of suggesting a new order. for interest, Interest-free days, and Minimum amount of interest charge per invoice will determine if interest charge should be suggested according to any of the two methods. Otherwise No charge will be suggested.

Using the side panel  you can in a quick an easy way go to order backlog and to invoice bases, in order to see if there is a future invoice in the pipeline.

you can in a quick an easy way go to order backlog and to invoice bases, in order to see if there is a future invoice in the pipeline.

Interest charge basis

In this procedure there is a list where you can see which payment records for invoices that have been paid too late and are awaiting interest charge. You use the procedure to create bases for interest charge or to deselect such invoices you do not wish to create an interest invoice for. In the list it is also possible to select how to charge the interest (in the same way as in the Incoming payments procedure).

Please note! The list is displayed per payment record. That is, if you have an invoice with partial payments then each payment record on the invoice is shown as a separate row in the list.

In the procedure you release payment records for interest charge via interest invoice by using the button Release interest invoices  on the toolbar. This affects the payment records with the Include checkbox marked and that has Interest invoice selected as method in the Interest charge in the list. The button for release is only active if a payment record meets both these two conditions. Depending on which method is selected in the Interest charge column in the list, the following will takes place:

on the toolbar. This affects the payment records with the Include checkbox marked and that has Interest invoice selected as method in the Interest charge in the list. The button for release is only active if a payment record meets both these two conditions. Depending on which method is selected in the Interest charge column in the list, the following will takes place:

- Interest invoice – This means that the interest is charged on a traditional interest invoice. When you use the release button in the list, an invoice basis of the type Interest invoice will be created (one basis per customer/currency). A control question appears asking if you want to release the invoices for invoicing. If you click OK in the control question, the procedure Review/Approve invoice will open. There you can review and approve the interest invoices. At the same time these payment records will disappear from the list. If you click Cancel, the release will be stopped and you will be returned to the list.

- Next regular invoice – This means that the interest charge will be added to the next regular invoice to the customer. When you release other payment records in the list for interest charge via interest invoice, nothing will happen with these payment records at that time. They will remain in the list until it is time for the next regular invoice to the customer in question. When a regular invoice to the customer then is to be reviewed and approved in the Review/Approve invoice procedure, you can add the interest to the invoice basis.

- No charge – This means that the accrued interest will not be charged. If you have selected this option to be used by default for the customer or if you have selected it for the payment, then the payment record will not be included in the list. But you can show that payment as well if you for the setting Charge to include in the procedure have checked the option No charge. You might for example have changed your mind and now want to charge the interest.

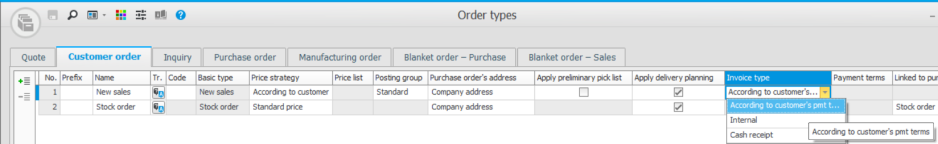

Using the setting Order type, interest invoice you can in the procedure decide which order type should be used when the interest invoice is created.

With the setting called Waiting time for next invoice, warn after: (number of days) in the procedure you configure that you wish to see a warning in the list after the entered number of days. This is done in order to find the interest charges which have been waiting for a long time for the next invoice. The payment records for which the number of days have been exceeded are shown with the payment date in red text in the list. This is an indicator that these invoices might be changed to being charged using interest invoice instead.

In the O column in the list, the checkbox is checked if there is order backlog or invoice bases not invoiced for the customer in question. This a good help to see if there are future invoices in the pipeline and this information helps you decide if interest should be charged on these invoices or not.

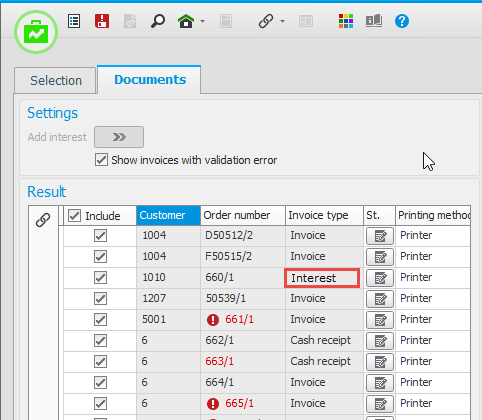

Review/Approve invoice

Invoicing interest invoices

If you released interest invoices in the Interest charge basis procedure this procedure will then be opened where you review and approve the interest invoices for invoicing and you can also print them. Even though you automatically is sent to that procedure to review and approve, you are not required to do it at that time. It is possible to close the procedure and open it at another occasion to do this. The interest invoices will remain among the other invoices to review and approve. This is shown in the Invoice type column where it says Interest for these invoices.

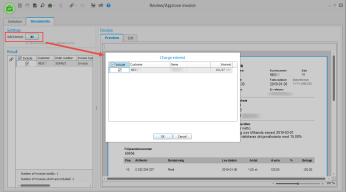

Charge interest on the next regular invoice

If there is interest to charge on the next regular invoice for a customer, this is shown in the procedure with the button Add interest being available at the top of the Result box. This button is only available if the next invoice for the customer is in the same currency as the interest to charge. You can click the button to open a dialog window where you can add interest to the regular invoice basis for the customer. The interest amount is shown in total for the customer. A warning is shown in the dialog window if there for a specific customer also exists interest to charge via interest invoice. This is an indicator that you might want to cancel the dialog window and change the method of interest charge of these interest items so they are charged on a regular invoice instead.

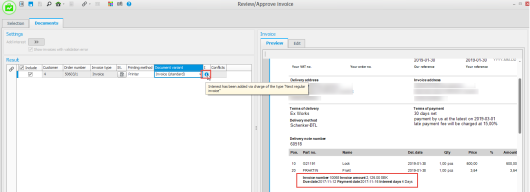

When you close the dialog window by using the OK button, it means that the interest will be added using one or several part rows on the customer's first invoice basis (with the service part you created earlier). Information about invoice number, invoice amount, due date, payment date, and number of interest days, is shown under the part row. Under the Preview tab you see the interest rows if you reload the interest basis. (This is done by clicking on another basis and then you again mark the first basis in the Result box). In that box an information symbol  is also shown to the right on the invoice row. A tooltip for the symbol lets you know that interest has been added, and that the it is of the type that should be charged on the next regular invoice.

is also shown to the right on the invoice row. A tooltip for the symbol lets you know that interest has been added, and that the it is of the type that should be charged on the next regular invoice.

Credit interest invoices

If you create an interest invoice via the procedure Register invoice directly (and when linking from the Accounts receivable list) you are allowed to credit an interest invoice. You can select which rows to credit. However, it is not possible to make price crediting on rows which refer to interest invoices.

Post/Record interest invoices

Integration settings and journals also apply to interest invoices in the same way as for customer invoices. That is, interest invoices are handled in the customer invoice journal/cancellation journal and they can also be recorded via direct integration with the accounting.

Update accounts receivable

If interest has not already been been invoiced or released for invoicing, then it is in this procedure possible to change the method for interest charge on a debit invoice. That is, to charge interest using an interest invoice, on the next regular invoice, or not to charge interest. You can in this procedure also create new accounts receivable records of the Interest invoice type.

Invoicing log

You can also see interest invoices in the invoicing log.

Undo release of interest invoices

If you by mistake have released interest invoices (not yet invoiced), then you can use the Undo delivery reporting procedure to undo these. Then these invoices will again become bases in the list in the Interest charge basis procedure.