Finnish VAT changes

The standard VAT rate in Finland increased from 24% to 25.5% on September 1, 2024. The new rate is applied to goods and services that were previously subject to the 24 percent VAT rate. In general, VAT is applied when goods are handed over to the buyer, i.e. delivered.

You can read more about VAT taxation here.

Managing the new VAT rate in Monitor ERP

VAT report number 30 has been updated with the new tax rate from version 24.6 of Monitor ERP.

For those of you who report your VAT monthly, we recommend you report your VAT for August before you update to 24.6. Your VAT report will not contain any errors if you have updated your system before reporting, but the control check for differences will be made against the new VAT rate of 25.5% instead of the old rate of 24%.

The system will not automatically make any changes in your VAT settings, this change needs to be made manually.

VAT settings

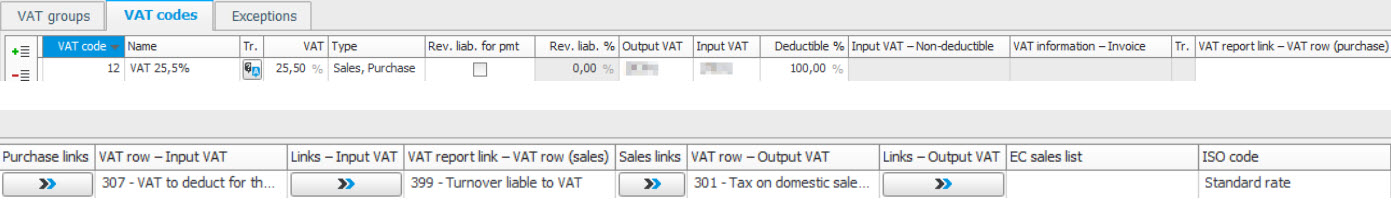

We recommend adding the new VAT codes for the new VAT rate and linking them to your VAT report. Below is an example of a new, domestic VAT code.

Once you have reported your VAT for August, we recommend you change any default VAT codes on your VAT groups that need to be changed. Below is an example of a domestic VAT group.

Updating the VAT code on customer and purchase orders

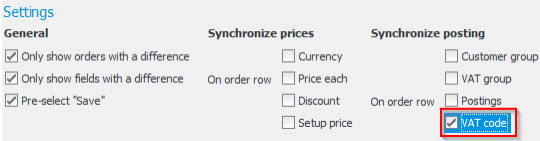

Once you have changed the default VAT codes on your VAT groups, you can update the VAT code on your customer orders via the Synchronize customer order procedure. Mark the VAT code setting under Synchronize posting as per the below example.

You can update the VAT code on purchase orders in the Order list – Purchase procedure. Select the Detailed list type and create a new presentation where you add the VAT code column as per the below example. You can mass update the VAT codes using the Find & replace function.

Updating the VAT code on customer and supplier invoice bases.

The VAT codes for Customer and supplier invoice bases are updated manually. You can update the VAT code for customer invoice bases in the Review/Approve invoice or Register invoice directly procedures.

You can update your VAT code for supplier invoice basis when linking the supplier invoice in the Register supplier invoice procedure.

Updating the VAT code in the chart of accounts

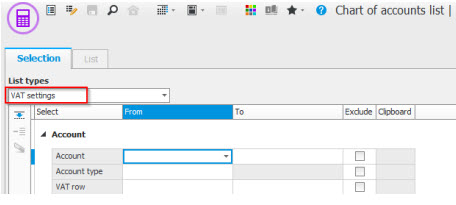

If the basis for the VAT report is loaded from the bookkeeping accounts, you can update the accounts’ VAT codes in the Chart of accounts list procedure with the list type VAT settings.