Estonian VAT changes

As of July 2025 Estonia will increase the standard VAT rate to 24%, instead of 22%. This means that you need to change some settings regarding VAT in Monitor ERP. Follow the step-by-step description below to ensure that your settings are correct.

Create VAT report

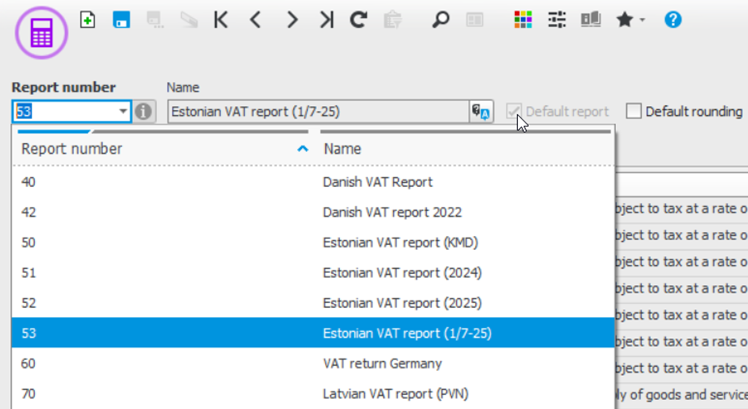

After updating to Monitor version 25.5 there is a new VAT report (number 53) available in the system. It can be found in the Create VAT report procedure. This is the new report which is valid as of July 2025.

Please note! This report will not automatically be default, you must manually select it.

Preferably you select number 53 as default VAT report after you have reported the VAT for June 2025. This is normally performed in July.

VAT settings

In the VAT settings procedure, you have to manually add the new VAT code for 24%, make all necessary settings for the VAT code and link it to the VAT row in the report. It’s OK to add this new VAT code before you’ve updated to version 25.5 but please be aware that you cannot link this row to the new VAT report (number 53).

Don’t forget to also add codes for the reversed purchase VAT codes.

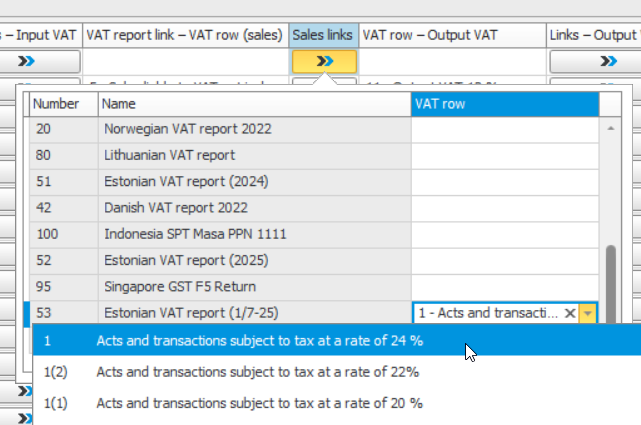

After the update to 25.5 you can link the new VAT codes to report number 53. If you do this before the default VAT report has been changed to number 53, you will need to link them using the Sales links button:

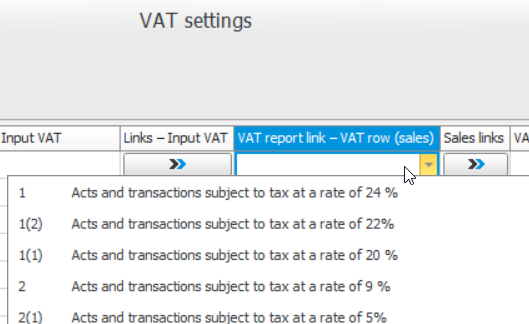

If you link the new codes after you’ve set report number 53 as default, you can link the row via the VAT report link – VAT row (sales) field:

Please note! You don’t have to link the code to the correct VAT row in report 53 before you start to use it.

You can start using the new code any time after July 1, 2025 and you can wait to connect the VAT code to the VAT report until after you have reported VAT for June. But when the VAT for July 2025 is to be reported, you have to link the new code to the VAT row 1 in report 53. This means that you can wait to update Monitor ERP to version 25.5 until you have reported the VAT for June.

When you update to 25.5 the existing VAT code links will automatically be updated. Codes linked to VAT row 1 will become linked to the new row "1(2)" in VAT report 53.

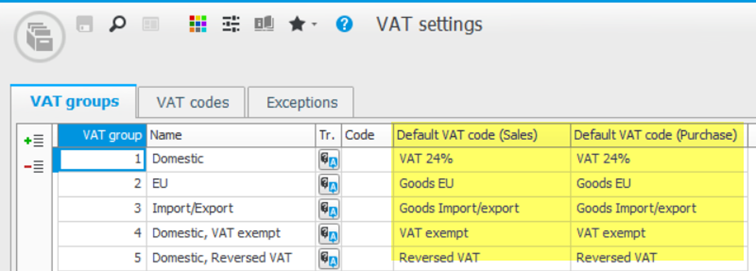

Since you want the new code 24% to be used on orders registered as of July 1, 2025 you should change the default code on the VAT groups here:

When going from June into July users must be aware that invoices prior to July should have VAT code 22%.

Print VAT report

When printing a VAT report and exporting the report to file, Monitor ERP will automatically export the correct version of XML depending on the chosen VAT report number. So, if you export number 50, 51 or 52 (depending on how long you’ve had Monitor) (the VAT used in June) it will be according to the “old” version. If you print number 53 (the VAT that should be used as of July), it will be according to the new version where the VAT code 22% will be shown on row "1(2)" (In the original Estonian VAT report this is also written as "12").

Customer/purchase orders and basis created before July, 2025

Existing orders (created before July 1) most likely have a VAT code of 22%. You can update the VAT codes on customer orders in a list by using the Synchronize customer order procedure. There you can choose to sync the VAT code on rows so the VAT code will be according to VAT group.

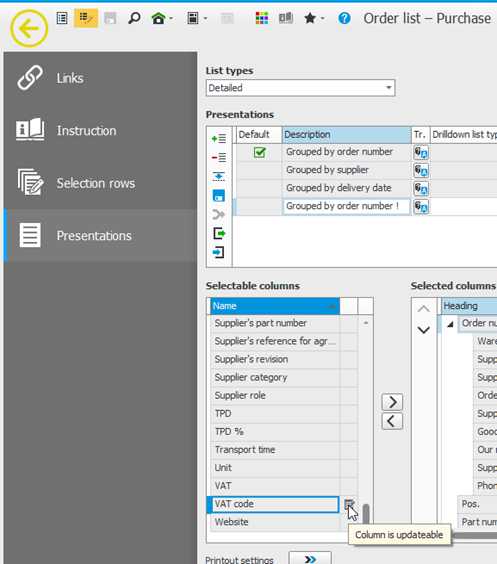

Existing purchase orders can be updated using the Order list – Purchase procedure. In the Detailed – Editable list type you can update VAT codes. Please note that you have to add the column from backstage by creating your own presentation:

Existing invoice bases in both the Sales and Purchase modules need to be manually updated. To avoid having to manually change the VAT code on multiple invoice bases, try to have as few invoice bases as possible before July, 2025. The bases you must manually update could be handled in either Review/Approve invoice or Register invoice directly procedures for invoice bases in the Sales module. The invoices bases in Invoice basis – Purchase procedure will be updated when you link the order to the invoice in the Register supplier invoice procedure in the Purchase module.