Upload the VAT report via API

Instructions and tips for uploading VAT reports directly from Monitor ERP to skat.dk.

You first need to add Monitor ERP System Danmark ApS (CVR-nummer: 38013378) as an authorized accountant/advisor on skat.dk.

You can do this yourself by logging into TastSelv Erhverv. You can find more information about this here.

In Monitor ERP

-

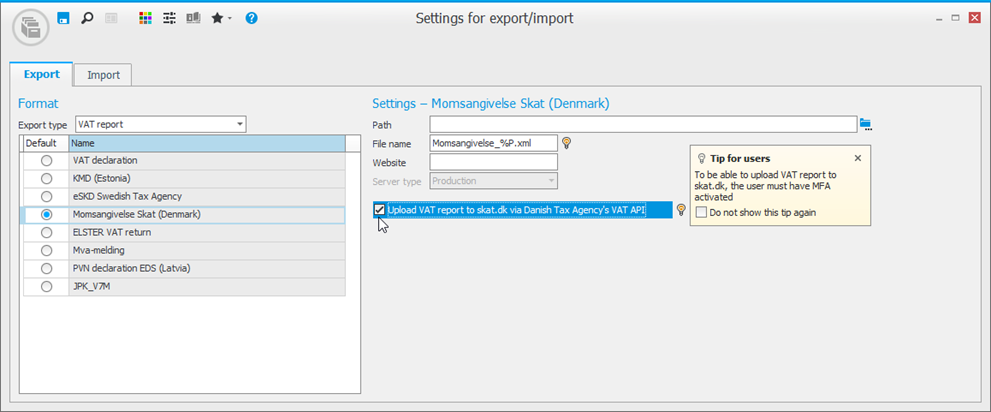

Settings for export/import

Momsangivelse Skat (Denmark) needs to be set as default. We also recommend that you enter a path for the file.

When you upload via API, you don’t need to visit any website as you will be automatically redirected to the website once the VAT report has been approved.

The Upload momsindberetning til skat.dk via Skattestyrelsens Moms API box must be checked.

-

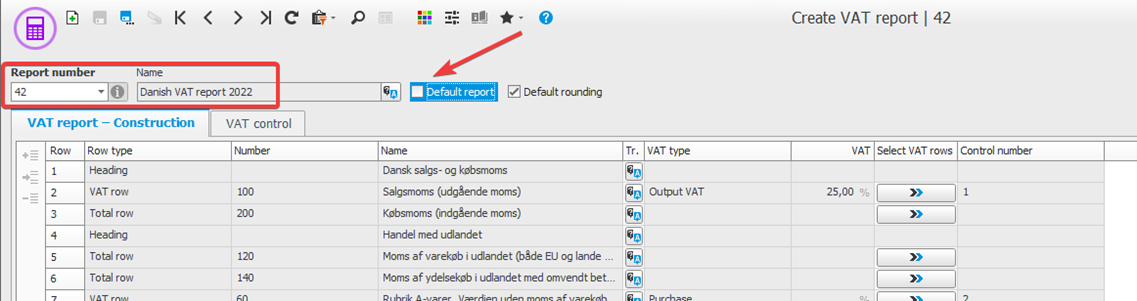

Create VAT report (Default VAT report)

By new systems, we means new installations from version 23.6 onwards. Migrated systems are installations made before version 23.6.-

If you have a migrated system you should have report number 42 as your default report.

-

If you have a new system (that doesn’t have report number 42), you should have report number 40 as your default report.

-

-

VAT settings

If you have a migrated system you need to ensure that all VAT codes are correctly linked to the VAT report.

-

Comparing VAT reports

If you have a migrated system, you need to compare your earlier VAT report with the new number 42 and make sure that the amounts are the same.

-

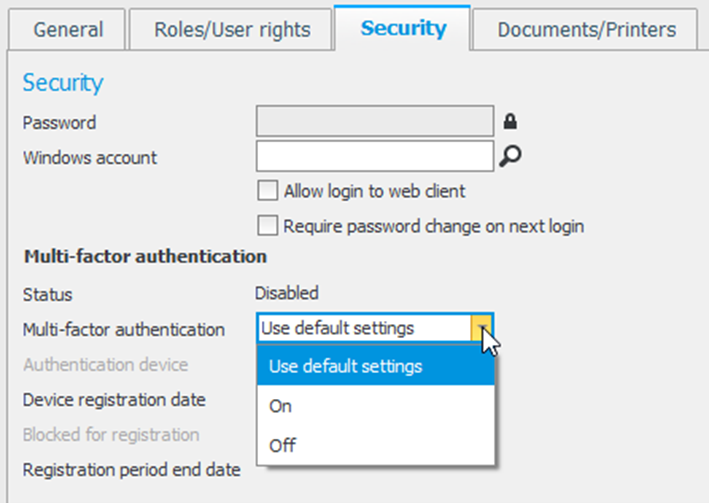

Multifactor authentication (MFA)

To be able to upload the VAT report, MFA must be activated for the user.

MFA can be activated for all users via the Security settings procedure or for individual users via the Users procedure. The procedures can be found in the General registers module.

-

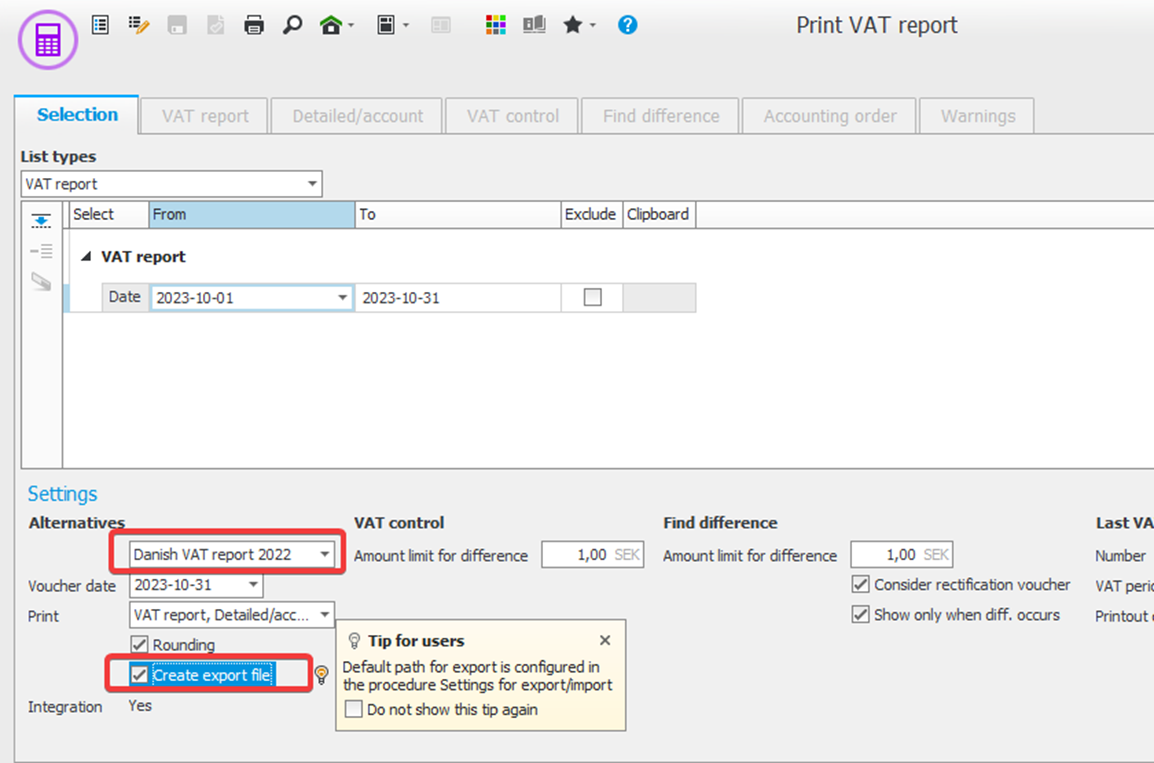

Print VAT report

When you print out the VAT report, make sure that you have selected the right VAT report and that the Create export file box is checked. These settings make it possible for you to upload the VAT report.

When the VAT report has been approved, a dialog box will appear asking whether you would like to save the file and upload the VAT report to Skat.

-

Desktop component

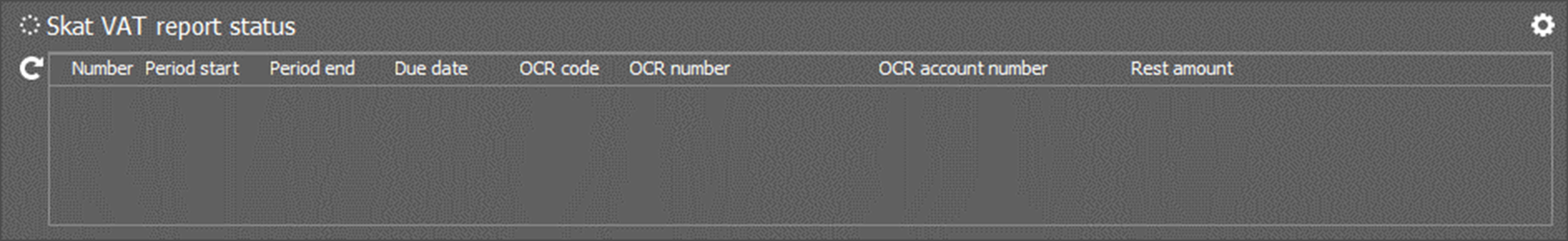

We recommend that you add the Skat status for momsindberetning component to your desktop. In the desktop component you can see receipts for uploaded VAT reports, amounts, etc. allowing for easy follow-up.